| Announcement of the General Administration of Customs | | 海关总署公告 |

| (No. 39 [2019]) | | (2019年第39号) |

| Announcement on Issuing the Measures of the Customs of the People's Republic of China for the Administration of the Origin of Imported and Exported Goods under the Free Trade Agreement between the Government of the People's Republic of China and the Government of the Republic of Chile | | 关于公布《中华人民共和国海关<中华人民共和国政府和智利共和国政府自由贸易协定>项下进出口货物原产地管理办法》的公告 |

| With the approval of the State Council, the Protocol of the Government of the People's Republic of China and the Government of the Republic of Chile on Revising the Free Trade Agreement and the Supplementary Agreement on Trade in Services of the Free Trade Agreement (hereinafter referred to as the “Protocol”) shall officially come into force on March 1, 2019. For the purposes of correctly determining the origin of imported and exported goods under the Free Trade Agreement between the Government of the People's Republic of China and the Government of the Republic of Chile, and promoting the economic and trade exchanges between China and Chile, the General Administration of Customs has developed the Measures of the Customs of the People's Republic of China for the Administration of the Origin of Imported and Exported Goods under the Free Trade Agreement between the Government of the People's Republic of China and the Government of the Republic of Chile, which are hereby issued and shall come into force on March 1, 2019. | | 经国务院批准,《中华人民共和国政府和智利共和国政府关于修订〈自由贸易协定〉及〈自由贸易协定关于服务贸易的补充协定〉的议定书》(以下简称《议定书》)自2019年3月1日起正式实施。为了正确确定《中华人民共和国政府和智利共和国政府自由贸易协定》项下进出口货物原产地,促进中国与智利的经贸往来,海关总署制定了《中华人民共和国海关〈中华人民共和国政府和智利共和国政府自由贸易协定〉项下进出口货物原产地管理办法》。现予以公布,自2019年3月1日起执行。 |

| | 特此公告。 |

| Annex: Measures of the Customs of the People's Republic of China for the Administration of the Origin of Imported and Exported Goods under the Free Trade Agreement between the Government of the People's Republic of China and the Government of the Republic of Chile | | 附件:中华人民共和国海关《中华人民共和国政府和智利共和国政府自由贸易协定》项下进出口货物原产地管理办法 |

| General Administration of Customs | | 海关总署 |

| February 28, 2019 | | 2019年2月28日 |

| Annex: | | 附件: |

| Measures of the Customs of the People's Republic of China for the Administration of the Origin of Imported and Exported Goods under the Free Trade Agreement between the Government of the People's Republic of China and the Government of the Republic of Chile | | 中华人民共和国海关《中华人民共和国政府和智利共和国政府自由贸易协定》 |

| | 项下进出口货物原产地管理办法 |

| Article 1 For the purposes of correctly determining the origin of imported and exported goods under the Free Trade Agreement between the Government of the People's Republic of China and the Government of the Republic of Chile, and promoting the economic and trade exchanges between China and Chile, these Measures are developed in accordance with the provisions of the Customs Law of the People's Republic of China (hereinafter referred to as the “Customs Law”) and the Protocol of the Government of the People's Republic of China and the Government of the Republic of Chile on Revising the Free Trade Agreement and the Supplementary Agreement on Trade in Services of the Free Trade Agreement (hereinafter referred to as the “Protocol”). | | |

| | 第一条 为了正确确定《中华人民共和国政府和智利共和国政府自由贸易协定》项下进出口货物的原产地,促进我国与智利的经贸往来,根据《中华人民共和国海关法》(以下简称《海关法》)和《中华人民共和国政府和智利共和国政府关于修订〈自由贸易协定〉及〈自由贸易协定关于服务贸易的补充协定〉的议定书》(以下简称《议定书》)的规定,制定本办法。 |

| Article 2 These Measures shall apply to the administration of the origin of imported and exported goods under the Free Trade Agreement between the Government of the People's Republic of China and the Government of the Republic of Chile between China and Chile (hereinafter referred to as the “China-Chile FTA”). | | |

| | 第二条 本办法适用于我国与智利之间的《中华人民共和国政府和智利共和国政府自由贸易协定》(以下简称《中智自贸协定》)项下进出口货物的原产地管理。 |

| Article 3 The imported and exported goods that satisfy any of the following conditions shall be considered as originating in China or Chile under the China-Chile FTA: | | |

| | 第三条 进出口货物符合下列条件之一的,应视为《中智自贸协定》项下中国或者智利原产货物: |

| (1) The goods are obtained or produced entirely in China or Chile. | | |

| | (一)在中国或者智利完全获得或者生产的; |

| (2) The goods are produced in China or Chile exclusively from originating materials in compliance with these Measures. | | |

| | (二)在中国或者智利全部使用符合本办法规定的原产材料生产的; |

| (3) The goods are obtained or produced not entirely in China or Chile: | | |

| | (三)在中国或者智利非完全获得或者生产的: |

| (a) The goods fall within the scope of application of the Product Specific Rules of Origin (Attachment 1) under the Protocol, and comply with the corresponding change in tariff classification, regional value content (“RVC”), manufacturing and processing procedures or other provisions. | | |

| | 1.属于《议定书》项下产品特定原产地规则(附1)适用范围,并且符合相应的税则归类改变、区域价值成分、制造加工工序或者其他规定的; |

| (b) The goods do not fall within the scope of application of the Product Specific Rules of Origin under the Protocol, but satisfy the requirement that the RVC is not less than 40%. | | |

| Any change of the Product Specific Rules of Origin under the Protocol as listed in Attachment 1 shall be announced separately by the General Administration of Customs. | | 2.不属于《议定书》项下产品特定原产地规则适用范围,但是满足区域价值成分不低于40%标准的。 |

| Where the goods originating in Chile are transported directly to the territory of China from Chile, an application may be filed for the application of the conventional tariff rate under the China-Chile FTA in the Import and Export Tariff of the People's Republic of China (hereinafter referred to as the “Tariff”) to the goods in accordance with the provisions of these Measures. | | 附1所列《议定书》项下产品特定原产地规则发生变化时由海关总署另行公告。 |

| | 原产于智利的货物,从智利境内直接运输至中国境内的,可以按照本办法规定申请适用《中华人民共和国进出口税则》(以下简称《税则》)中的《中智自贸协定》协定税率。 |

| Article 4 For the purpose of subparagraph (1) of Article 3 of these Measures, “goods obtained or produced entirely in China or Chile” means | | |

| | 第四条 本办法第三条第(一)项所述“在中国或者智利完全获得或者生产”的货物是指: |

| (1) live animals born and raised in China or Chile; | | |

| | (一)在中国或者智利出生并且饲养的活动物; |

| (2) products obtained from live animals raised in China or Chile; | | |

| | (二)在中国或者智利从在该方饲养的活动物中获得的产品; |

| (3) plants and plant products harvested in China or Chile; | | |

| | (三)在中国或者智利收获的植物和植物产品; |

| (4) goods obtained from hunting, trapping, fishing, aquaculture, or capturing conducted in China or Chile; | | |

| | (四)在中国或者智利狩猎、诱捕、捕捞、水产养殖获得或者捕获获得的的货物; |

| (5) minerals extracted or obtained from the relevant soil or seabed of China or Chile; | | |

| | (五)从中国或者智利相关的土壤或者海床提取的矿产品; |

| (6) products extracted or obtained from the seabed or seabed subsoil which is outsidethe territorial seasof China or Chile and to which China or Chile has the right to exploit; | | |

| | (六)在中国或者智利领海以外、中国或智利有权开发的海床或者海床底土提取的产品; |

| (7) fish and other products obtained from fishing in territorial waters of China or Chile; | | |

| | (七)在中国或者智利的领水捕捞获得的鱼类和其他产品; |

| (8) fish and other marine products obtained from fishing in sea areas other than territorial waters of China or Chile by vessels registered in China or Chile and flying its national flag; | | |

| | (八)由在中国或者智利注册或者登记并悬挂其国旗的船舶在该方领水以外海域捕捞获得的鱼类以及其他海洋产品; |

| (9) goods processed and manufactured exclusively from goods as mentioned in subparagraphs (7) and (8) on board processing vessels registered in China or Chile and flying its national flag; | | |

| | (九)在中国或者智利注册或者登记并悬挂其国旗的加工船上完全用本条第(七)项和第(八)项所述货物制造或者加工的货物; |

| (10) wastes and scraps derived from production and processing in China or Chile,neither usable for their original purpose nor restorable or repairable, and fit only for the recovery of raw materials; | | |

| | (十)在中国或者智利生产加工过程中产生的,既不能用于原用途,也不能恢复或者修理,并且仅适用于原材料回收的废碎料; |

| (11) old goods consumed and collected in China or Chile, neither usable for their original purpose nor restorable or repairable, and fit only for the recovery of raw materials; and | | |

| | (十一)在中国或者智利消费并收集的,既不能用于原用途,也不能恢复或者修理,并且仅适用于原材料回收的旧货物; |

| (12) goods produced in China or Chile exclusively from the goods listed in subparagraphs (1) to (11) of this article. | | |

| | (十二)在中国或者智利完全从本条第(一)项至第(十一)项所列货物生产的货物。 |

| Article 5 For the purpose of paragraph 1(3) of Article 3 of these Measures, “change in tariff classification” means the change of codes of the Harmonized Commodity Description and Coding System (“HS”) after the manufacturing and processing of goods in China or Chile with non-originating materials. | | |

| | 第五条 本办法第三条第一款第(三)项规定的税则归类改变是指使用非原产材料在中国或者智利进行制造、加工后,在《协调制度》中的相应编码发生改变。 |

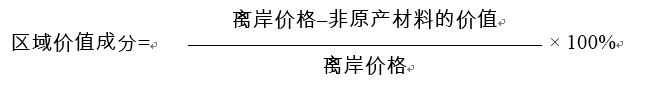

| Article 6 For the purpose of paragraph 1(3) of Article 3 of these Measures, “RVC criterion” shall be calculated based on the following formula: | | |

| RVC = (FOB value - Value of non-originating materials) /FOB value ×100% | | 第六条 本办法第三条第一款第(三)项中所规定的区域价值成分标准应当根据下列公式计算: |

| “Value of non-originating materials” means the import costs of non-originating materials and the freights and insurance premiums for transportation to the port or place of destination, including the price of the materials of unidentifiable origin. When the non-originating materials are acquired within the territory of China or Chile, the value of non-originating materials shall be the price actually paid or payable of the non-originating materials determined by this side at the earliest, excluding the freights, insurance premiums, packaging charges and all other expenses incurred during the transportation of such non-originating materials from the warehouses of the suppliers to the places where the manufacturers are located. | |  |

| When RVC of goods calculated in accordance with paragraph 1 of this Article, the value of non-originating materials excludes the price of non-originating materials used for producing raw materials in the process of production. | | 其中, “非原产材料的价值”是指非原产材料的进口成本、运至目的港口或者地点的运费和保险费,包括不明原产地材料的价格。非原产材料在中国或者智利境内获得时,应当是在该方最早确定的非原产材料的实付或应付价格,不包括将该非原产材料从供应商仓库运抵生产商所在地的运费、保险费、包装费及其他任何费用。 |

| The calculation of the “RVC” as mentioned in paragraph 1 of this article shall comply with the generally accepted accounting principles and the Customs Valuation Agreement. | | 根据本条第一款计算货物的区域价值成分时,非原产材料价值不包括在生产过程中为生产原产材料而使用的非原产材料的价格。 |

| | 本条第一款所述“区域价值成分”的计算应当符合公认的会计原则及《海关估价协定》。 |

| Article 7Where the goods or materials originating in China are used for producing other goods within the territory of Chile, such goods or materials shall be deemed as materials originating in Chile. | | |

| Where the goods or materials originating in Chile are used for producing other goods within the territory of China, such goods or materials shall be deemed as materials originating in China. | | 第七条 原产于中国的货物或者材料在智利境内被用于生产另一货物的,该货物或者材料应当视为智利原产材料。 |

| | 原产于智利的货物或者材料在中国被用于生产另一货物的,该货物或者材料应当视为中国原产材料。 |

| Article 8 For the goods to which the requirements for change in tariff classification under the Protocol apply, if the non-originating materials used in the process of production fail to meet the requirements for change in tariff classification, but the price of the aforesaid non-originating materials determined in accordance with Article 6 of these Measures is not more than 10% of the FOB value of such goods, and such goods conform to all other applicable provisions of these Measures, such goods shall be deemed as originating in China or Chile. | | |

| | 第八条 适用《议定书》项下税则归类改变要求的货物,生产过程中所使用的非原产材料不满足税则归类改变要求,但是上述非原产材料按照本办法第六条确定的价格不超过该货物离岸价格的10%,并且货物符合本办法所有其他适用规定的,应当视为原产货物。 |

| Article 9 The following minor processing or treatment shall not affect the determination of the origin of goods: | | |

| | 第九条 下列微小加工或者处理不影响货物原产地确定: |

| (1) The protective operations necessary to keep the goods in good conditions during their transport or storage. | | |

| ...... | | (一)为确保货物在运输或者储藏期间保持良好状态而进行的保护性操作;

...... |

|

Dear visitor, as a premium member of this database, you will get complete access to all content.Please go premium and get more.

1. To become a premium member, please call 400-810-8266 Ext. 171.

2. Binding to the account with access to this database.

3. Apply for a trial account.

4. To get instant access to a document, you can Pay Amount 【¥800.00】 for your single purchase. | |

您好:您现在要进入的是北大法宝英文库会员专区。

如您是我们英文用户可直接 登录,进入会员专区查询您所需要的信息;如您还不是我们 的英文用户;您可通过网上支付进行单篇购买,支付成功后即可立即查看本篇内容。

Tel: +86 (10) 82689699, +86 (10) 82668266 ext. 153

Mobile: +86 13311570713

Fax: +86 (10) 82668268

E-mail:info@chinalawinfo.com

|

| | | |

| | | |