|

|

|

|

|

|

|

|

|

|

|

|

|

| The Facts and China's Position on China-US Trade Friction | | 关于中美经贸摩擦的事实与中方立场 |

| (September 2018) | | (2018年9月) |

| (Information Office of the State Council of the People's Republic of China) | | 中华人民共和国国务院新闻办公室 |

| CONTENT | | 目录 |

| Foreword | | 前言 |

| I. Mutually-beneficial and win-win cooperation between China and the US in trade and economy | | 一、中美经贸合作互利共赢 |

| II. Clarifications of the facts about China-US trade and economic cooperation | | 二、中美经贸关系的事实 |

| III. The trade protectionist practices of the US administration | | 三、美国政府的贸易保护主义行为 |

| IV. The trade bullyism practices of the US administration | | 四、美国政府的贸易霸凌主义行为 |

| V. Damage of the improper practices of the US administration to global economy | | 五、美国政府不当做法对世界经济发展的危害 |

| VI. China's position | | 六、中国的立场 |

| Foreword | | 前言 |

| China is the world's biggest developing country and the United States is the biggest developed country. Trade and economic relations between China and the US are of great significance for the two countries as well as for the stability and development of the world economy. | | 中国是世界上最大的发展中国家,美国是世界上最大的发达国家。中美经贸关系既对两国意义重大,也对全球经济稳定和发展有着举足轻重的影响。 |

| Since the establishment of diplomatic relations, bilateral trade and economic ties between China and the US have developed steadily. A close partnership has been forged under which interests of the two countries have become closer and wider. Both countries have benefited from this partnership, as has the rest of the world. Since the beginning of the new century in particular, alongside rapid progress in economic globalization, China and the US have observed bilateral treaties and multilateral rules such as the WTO rules, and economic and trade relations have grown deeper and wider. Based on their comparative strengths and the choices of the market, the two countries have built up a mutually beneficial relationship featuring structural synergy and convergence of interests. Close cooperation and economic complementarity between China and the US have boosted economic growth, industrial upgrading and structural optimization in both countries, and at the same time enhanced the efficiency and effectiveness of global value chains, reduced production costs, offered greater product variety, and generated enormous benefit for businesses and consumers in both countries. | | 中美两国建交以来,双边经贸关系持续发展,利益交汇点不断增多,形成了紧密合作关系,不仅使两国共同获益,而且惠及全球。特别是进入新世纪以来,在经济全球化快速发展过程中,中美两国遵循双边协定和世界贸易组织等多边规则,拓展深化经贸合作,基于比较优势和市场选择形成了结构高度互补、利益深度交融的互利共赢关系。双方通过优势互补、互通有无,有力促进了各自经济发展和产业结构优化升级,同时提升了全球价值链效率与效益,降低了生产成本,丰富了商品种类,极大促进了两国企业和消费者利益。 |

| China and the US are at different stages of development. They have different economic systems. Therefore some level of trade friction is only natural. The key however lies in how to enhance mutual trust, promote cooperation, and manage differences. In the spirit of equality, rationality, and moving to meet each other halfway, the two countries have set up a number of communication and coordination mechanisms such as the Joint Commission on Commerce and Trade, the Strategic and Economic Dialogue, and the Comprehensive Economic Dialogue. Each has made tremendous efforts to overcome all kinds of obstacles and move economic and trade relations forward, which has served as the ballast and propeller of the overall bilateral relationship. | | 中美两国经济发展阶段、经济制度不同,存在经贸摩擦是正常的,关键是如何增进互信、促进合作、管控分歧。长期以来,两国政府本着平等、理性、相向而行的原则,先后建立了中美商贸联委会、战略经济对话、战略与经济对话、全面经济对话等沟通协调机制,双方为此付出了不懈努力,保障了中美经贸关系在近40年时间里克服各种障碍,不断向前发展,成为中美关系的压舱石和推进器。 |

| Since taking office in 2017, the new administration of the US government has trumpeted “America First”. It has abandoned the fundamental norms of mutual respect and equal consultation that guide international relations. Rather, it has brazenly preached unilateralism, protectionism and economic hegemony, making false accusations against many countries and regions - particularly China - intimidating other countries through economic measures such as imposing tariffs, and attempting to impose its own interests on China through extreme pressure. China has responded from the perspective of the common interests of both parties as well as the world trade order. It is observing the principle of resolving disputes through dialogue and consultation, and answering the US concerns with the greatest level of patience and good faith. The Chinese side has been dealing with these differences with an attitude of seeking common ground while shelving divergence. It has overcome many difficulties and made enormous efforts to stabilize China-US economic and trade relations by holding rounds of discussions with the US side and proposing practical solutions. However the US side has been contradicting itself and constantly challenging China. As a result, trade and economic friction between the two sides has escalated quickly over a short period of time, causing serious damage to the economic and trade relations which have developed over the years through the collective work of the two governments and the two peoples, and posing a grave threat to the multilateral trading system and the principle of free trade. | | 2017年新一届美国政府上任以来,在“美国优先”的口号下,抛弃相互尊重、平等协商等国际交往基本准则,实行单边主义、保护主义和经济霸权主义,对许多国家和地区特别是中国作出一系列不实指责,利用不断加征关税等手段进行经济恫吓,试图采取极限施压方法将自身利益诉求强加于中国。面对这种局面,中国从维护两国共同利益和世界贸易秩序大局出发,坚持通过对话协商解决争议的基本原则,以最大的耐心和诚意回应美国关切,以求同存异的态度妥善处理分歧,克服各种困难,同美国开展多轮对话磋商,提出务实解决方案,为稳定双边经贸关系作出了艰苦努力。然而,美国出尔反尔、不断发难,导致中美经贸摩擦在短时间内持续升级,使两国政府和人民多年努力培养起来的中美经贸关系受到极大损害,也使多边贸易体制和自由贸易原则遭遇严重威胁。 |

| In order to clarify the facts about China-US economic and trade relations, clarify China's stance on trade friction with the US, and pursue reasonable solutions, the government of China is publishing this White Paper. | | 为澄清中美经贸关系事实,阐明中国对中美经贸摩擦的政策立场,推动问题合理解决,中国政府特发布此白皮书。 |

| I. Mutually-beneficial and win-win cooperation between China and the US in trade and economy | | 一、中美经贸合作互利共赢 |

| Economic and trade relations have developed steadily since the establishment of diplomatic ties between China and the US, with fruitful results achieved in trade and investment. China benefits remarkably from the strong synergy, while the US also reaps extensive economic benefits from the opportunities and results generated by China's growth. It is self-evident that a sound China-US economic and trade relationship is very important for both countries. Cooperation serves the interests of the two sides and conflict can only hurt both. | | 中美建交以来,双边经贸关系不断发展,贸易和投资等合作取得丰硕成果,实现了优势互补、互利共赢。中国从中受益匪浅,美国也从中获得了广泛、巨大的经济利益,分享了中国发展带来的机遇和成果。事实证明,良好的中美经贸关系对两国发展都具有重要意义,合则两利,斗则两伤。 |

| 1. China and the US are important partners for each other in trade in goods. | | (一)中美双方互为重要的货物贸易伙伴 |

| Two-way trade in goods has grown rapidly. Chinese statistics show that trade in goods between China and the US in 2017 amounted to US$583.7 billion, a 233-fold increase from 1979 when the two countries forged diplomatic ties, as well as a seven-fold increase from 2001 when China joined the World Trade Organization. Currently, the US is China's biggest export market and sixth biggest source of imports. In 2017, the US took 19% of China's exports and provided 8% of China's imports. China is the fastest growing export market for US goods and the biggest source of imports of the United States. In 2017, 8% of US exports went to China. | | 双边货物贸易快速增长。根据中国有关部门统计数据,2017年中美双边货物贸易额达5837亿美元,是1979年建交时的233倍,是2001年中国加入世界贸易组织时的7倍多。目前,美国是中国第一大货物出口市场和第六大进口来源地,2017年中国对美国出口、从美国进口分别占中国出口和进口的19%和8%;中国是美国增长最快的出口市场和第一大进口来源地,2017年美国对华出口占美国出口的8%。 |

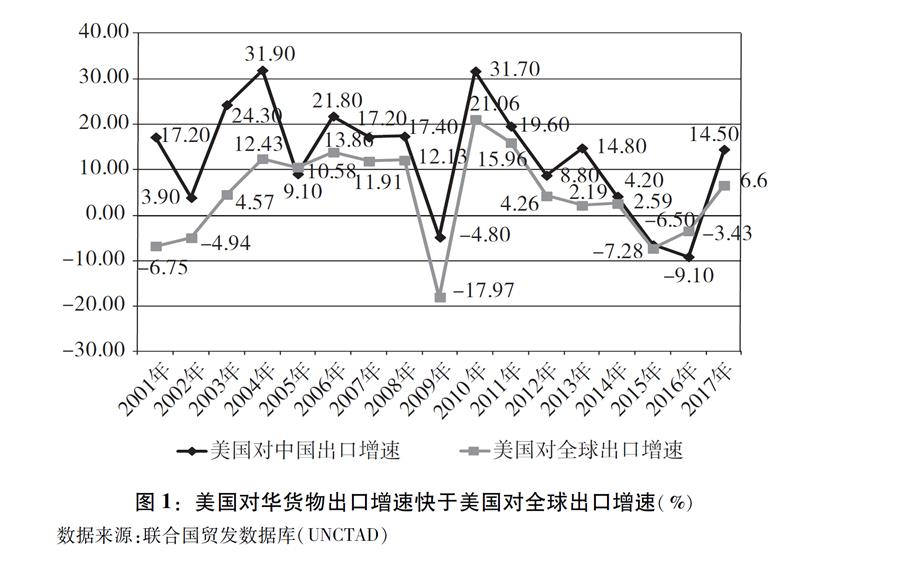

| US exports to China are growing much faster than its global average. Since its accession to the WTO, China has become an important market for US exports, which have grown rapidly. UN statistics indicate that in 2017 US exports of goods to China amounted to US$129.89 billion, a 577% increase from US$19.18 billion in 2001, and far higher than the 112% average growth rate of overall US exports (Chart 1). | | 美国对华出口增速明显快于其对全球出口。中国加入世界贸易组织以来,美国对华出口快速增长,中国成为美国重要的出口市场。根据联合国统计,2017年美国对华货物出口1298.9亿美元,较2001年的191.8亿美元增长577%,远远高于同期美国对全球112%的出口增幅(图1)。 |

| |  |

| Chart 1: US Exports to China Grow Faster than its Global Export Trade (%) | | 图表:图1:美国对华货物出口增速快于美国对全球出口增速(%) 新华社发 |

China is an import market for US goods such as airplanes, agricultural produce, automobiles, and integrated circuits. China represents the No. 1 export market for US airplanes and soybeans, and the No. 2 export market for US automobiles, IC products and cotton. In 2017 China took 57% of US soybean exports, 25% of Boeing aircraft, 20% of automobiles, 14% of ICs and 17% of cotton. | | 中国是美国飞机、农产品、汽车、集成电路的重要出口市场。中国是美国飞机和大豆的第一大出口市场,汽车、集成电路、棉花的第二大出口市场。2017年美国出口中57%的大豆、25%的波音飞机、20%的汽车、14%的集成电路、17%的棉花都销往中国。 |

| China-US bilateral trade has a strong complementarity. The US stands at the mid-and high-end in global value chains and it exports capital goods and intermediary goods to China. Remaining at the mid-and low-end in global value chains, China mainly exports consumer goods and finished products to the US. The two countries play to their comparative strengths and the two-way trade is highly complementary. In 2017, the top three categories of Chinese exports to the US were: 1. electric machines/electrical products/equipment and components, 2. mechanical apparatus and components, and 3. furniture/bedding/lamps, which accounted for 53.5% of its total exports to the US. The top three categories of products that China imported from the US were:1. machinery/electric equipment/ components and accessories, 2. mechanical apparatus and components, and 3. automobile and components and accessories, which accounted for 31.8% of total import from the US. Machinery and electronic products take a lion's share of two-way trade, and there is an evident characteristic of intra-industry trade. (Table 1) For most of the hi-tech products that China exports to the US, only labor-intensive processing takes place in China, involving large-scale import of key components and intermediary products as well as international transfer of value. | | 中美双边贸易互补性强。美国居于全球价值链的中高端,对华出口多为资本品和中间品,中国居于中低端,对美出口多为消费品和最终产品,两国发挥各自比较优势,双边贸易呈互补关系。2017年中国向美国出口前三大类商品为电机电气设备及其零附件、机械器具及零件、家具寝具灯具等,合计占比为53.5%。中国从美国进口前三大类商品为电机电气设备及其零附件、机械器具及零件、车辆及其零附件,合计占比为31.8%。机电产品在中美双边贸易中占重要比重,产业内贸易特征较为明显(表1)。中国对美出口的“高技术产品”,大多只是在华完成劳动密集型加工环节,包含大量关键零部件和中间产品的进口与国际转移价值。 |

| |  |

| Table 1: Major China's imports from and exports to the US (HS 2-digit) | | 图表:表1:2017年中国对美国主要进、出口商品(HS2位码) 新华社发 |

| | |

| 2. Bilateral trade in services is developing quickly. | | (二)中美双边服务贸易快速增长 |

| The US has a highly-advanced and fully-fledged service industry which is very competitive on the international market. Accompanying the growth of the Chinese economy and the improvement of Chinese people's living standards is an obvious rise in demand for services and rapid growth in bilateral services trade. According to US statistics, two-way trade in services rose from US$24.94 billion in 2007 to US$75.05 billion in 2017. According to MOFCOM, the US was China's second biggest services trade partner; according to USDOC, China is the third biggest market for US service exports. | | 美国服务业高度发达,产业门类齐全,国际竞争力强。随着中国经济发展和人民生活水平提升,服务需求明显扩大,双方服务贸易快速增长。据美国方面统计,2007-2017年,中美服务贸易额由249.4亿美元扩大到750.5亿美元,增长了2倍。2017年,据中国商务部统计,美国是中国第二大服务贸易伙伴;据美国商务部统计,中国是美国第三大服务出口市场。 |

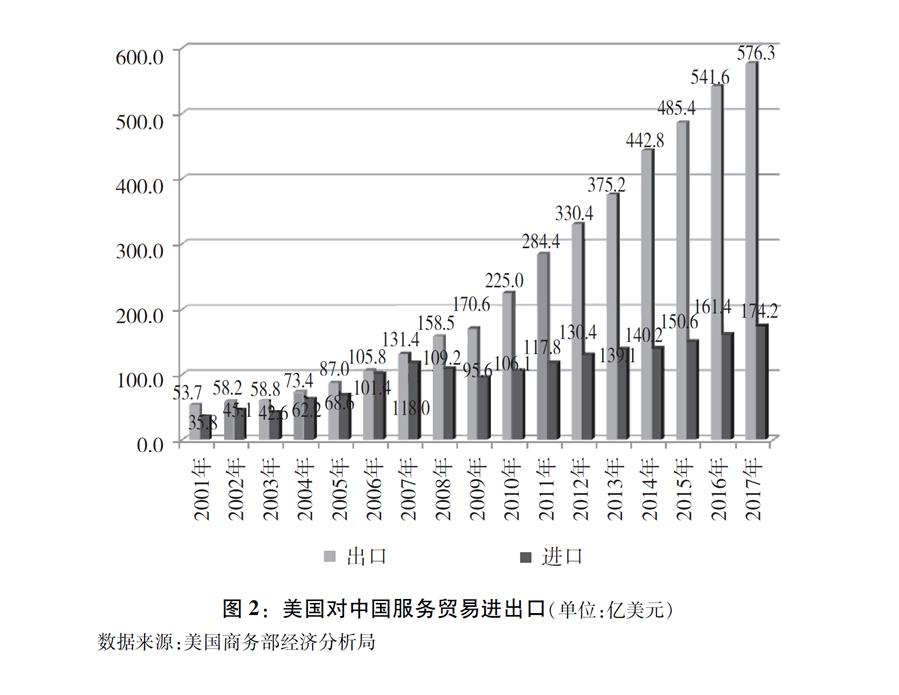

| The US is the biggest source of China's deficit in services trade and this deficit has been increasing fast. US statistics show that US service exports to China grew 340% from US$13.14 billion in 2007 to US$57.63 billion in 2017 while its service exports to other countries and regions in the same period grew by 180%. The US surplus with China in services multiplied by a factor of 30 to US 40.2 billion. (Chart 2) | | 美国是中国服务贸易最大逆差来源地,且逆差快速扩大。据美国方面统计,2007-2017年,美国对华服务出口额由131.4亿美元扩大到576.3亿美元,增长了3.4倍,而同期美国对世界其他国家和地区的服务出口额增长1.8倍,美国对华服务贸易年度顺差扩大30倍至402亿美元(图2)。 |

| |  |

| Chart 2: US Services Imports from and Exports to China (unit: US$100 mn) | | 图表:图2:美国对中国服务贸易进出口(单位:亿美元) 新华社发 |

At present, the US represents roughly 20% of China's total deficit in services trade, the biggest source of this deficit. China's deficit with the US is concentrated in three areas, travel, transport and intellectual property royalties. | | 目前,美国是中国服务贸易逆差最大来源国,占中国服务贸易逆差总额的20%左右。中国对美服务贸易逆差主要集中在旅行、运输和知识产权使用费三个领域。 |

| China's trade deficit with the US in tourism continues to widen. According to the DOC, by 2016 the number of Chinese mainland visitors to the US had been increasing for 13 consecutive years, with double-digit growth in 12 of the 13 years. MOFCOM statistics suggest that in 2017 Chinese visitors going to the US for tourism, education, and medical treatment spent a total of US$51 billion in the US. Among them, 3 million were tourists, who spent as much as US$33 billion while traveling in the US. In education, the US is the largest overseas destination for Chinese students. In 2017, there were around 420,000 Chinese students in the US, contributing some US$18 billion to local revenues. According to US figures, China's trade deficit with the US in tourism grew from US$430 million in 2006 to US$26.2 billion in 2016, registering an average annual growth of 50.8%. | | 中国对美旅行服务贸易逆差不断扩大。据美国商务部统计,截至2016年,中国内地到访美国的游客数量已连续13年增长,其中12年的增速都达到两位数。中国商务部统计显示,2017年中国游客赴美旅游、留学、就医等旅行支出合计达510亿美元,其中赴美游客约300万人次,在美旅游支出高达330亿美元。在教育方面,美国是中国学生出境留学第一大目的地,2017年中国在美留学生约42万人,为美国贡献约180亿美元收入。根据美国方面统计,中国对美国旅行服务贸易逆差从2006年的4.3亿美元扩大至2016年的262亿美元,年均增长50.8%。 |

| China's payments for the use of US intellectual property continues to rise. Chinese statistics indicate that the US is the largest source of intellectual property imports to China. From 2012 to 2016, China imported nearly 28,000 items of intellectual property from the US. China's payments for US intellectual property doubled in six years from US$3.46 billion in 2011 to US$7.2 billion in 2017. (Chart 3) In breakdown, China's intellectual property payments to the US accounted for a quarter of its total intellectual property payments to foreign countries. | | 中国对美国支付知识产权使用费持续增加。据中国有关方面统计,美国是中国第一大版权引进来源国,2012-2016年,中国自美国引进版权近2.8万项。中国对美国支付的知识产权使用费从2011年的34.6亿美元增加至2017年的72亿美元,6年时间翻了一番(图3)。其中2017年中国对美支付占中国对外支付知识产权使用费总额的四分之一。 |

| |  |

| Chart 3: China's Payment for the Use of US Intellectual Property | | 图表:图3:中国对美国支付知识产权使用费情况 新华社发 |

| | |

| 3. China and the US are important investment partners. | | (三)中美互为重要的投资伙伴 |

| The US is a major source of foreign investment for China. According to MOFCOM, by the end of 2017, there were approximately 68,000 US-funded enterprises in China with over US$83 billion in actualized investment. With a rapid increase in direct investment by Chinese enterprises in the US, the latter has become an important destination for Chinese investment. As China's outbound investment grew, Chinese enterprises' direct investment in the US rose from US$65 million in 2003 to US$16.98 billion in 2016. According to MOFCOM figures, by the end 2017, the stock of Chinese direct investment in the US amounted to approximately US$67 billion. Meanwhile, China has also made a significant financial investment in the US. According to the US Treasury Department, China held US$1.18 trillion of US treasury bills by the end of May 2018. | | 美国是中国重要外资来源地。根据中国商务部统计,截至2017年,美国累计在华设立外商投资企业约6.8万家,实际投资超过830亿美元。中国企业对美国直接投资快速增长,美国成为中国重要的投资目的地。随着中国对外投资的发展,中国企业对美国直接投资从2003年的0.65亿美元增长至2016年的169.8亿美元。根据中国商务部统计,截至2017年,中国对美直接投资存量约670亿美元。与此同时,中国还对美国进行了大量金融投资。根据美国财政部统计,截至2018年5月底,中国持有美国国债1.18万亿美元。 |

| 4. China and the US have both benefited markedly from trade and economic cooperation. | | (四)中美双方均从经贸合作中明显获益 |

| China and the US have both reaped enormous benefits and created win-win results from trade and economic cooperation. | | 中美双方从经贸合作中获得巨大的经济利益,实现了互利共赢。 |

| China-US trade and economic cooperation has promoted economic development in China and improved economic wellbeing. Against the backdrop of economic globalization, strengthening trade and investment cooperation with other countries, including the US, and opening up markets to each other has helped Chinese enterprises integrate into the global industrial chain and value chain, and opened up a huge external market for Chinese economic growth. Thanks to economic development over the past 40 years of reform and opening up, in 2017 China became the world's largest trader in goods, with US$4.1 trillion of total merchandise imports and exports. It became the second largest trader in services with US$695.68 billion worth of total services imports and exports. And it became the second largest recipient of FDI, with US$136 billion of inward foreign investment. American firms have played an exemplary role in China for their Chinese peers in terms of technological innovation, marketing management, and institutional innovation. They have promoted market competition, improved industry efficiency, and motivated Chinese firms to improve their technology and management. In importing a large number of mechanical and electrical products and agricultural products from the US, China has managed to make up for its own supply deficiencies, and satisfy the demand—especially high-end demand—in various sectors by offering consumers a diversity of choice. | | 中美经贸合作促进了中国经济发展和民生改善。在经济全球化背景下,中国与美国等国加强贸易和投资合作,相互开放市场,有利于中国企业融入全球产业链价值链,为中国经济增长带来了可观的外部市场。经过改革开放以来40年的发展,2017年中国货物贸易进出口总额4.1万亿美元,居世界首位;服务贸易进出口总额6956.8亿美元,居世界第二位;吸引外商投资1363亿美元,居世界第二位。美国在华企业在技术创新、市场管理、制度创新等方面对中国企业起到了示范作用,促进了市场竞争,提升了行业效率,带动了中国企业提高技术和管理水平。中国从美国进口大量机电产品和农产品,弥补了自身供给能力的不足,满足了各领域需求特别是高端需求,丰富了消费者选择。 |

| At the same time, the US has gained access to a wide range of business opportunities such as cross-border investment and entry into the China market, which have played a big part in driving economic growth, improving consumer welfare, and upgrading the economic structure in the US. | | 与此同时,美国获得了跨境投资、进入中国市场等大量商业机会,对美国经济增长、消费者福利、经济结构升级都发挥了重要作用。 |

| Trade and economic cooperation has supported US economic growth and lowered US inflation. A joint estimate by the US-China Business Council and Oxford Economics indicated that in 2015 imports from China drove up the US gross domestic product by 0.8 percentage points. Exports to China and two-way investment contributed US$216 billion to America's GDP, pushing US economic growth rate up by 1.2 percentage points. Value-for-money products from China drove down prices for American consumers, and in 2015 for example, reduced the consumer price index by 1 to 1.5 percentage points. A low inflation environment has created much room for expansionary macroeconomic policies in the US. | | 经贸合作促进了美国经济增长,降低了美国通胀水平。据美中贸易全国委员会和牛津研究院联合研究估算,2015年美国自华进口提振了美国国内生产总值0.8个百分点;美国对华出口和中美双向投资为美国国内生产总值贡献了2160亿美元,提升美国经济增长率1.2个百分点;来自中国物美价廉的商品降低了美国消费者物价水平,如2015年降低其消费物价水平1-1.5个百分点。低通货膨胀环境为美国实施扩张性宏观经济政策提供了较大空间。 |

| Trade and economic cooperation has created a large number of jobs in the US. According to a US-China Business Council estimate, in 2015, US exports to China and US-China two-way investment supported 2.6 million jobs in America. Specifically, Chinese investment covered 46 states of the US, generating for the US more than 140,000 jobs, most of which are in manufacturing. | | 为美国创造了大量就业机会。据美中贸易全国委员会估算,2015年美国对华出口和中美双向投资支持了美国国内260万个就业岗位。其中,中国对美投资遍布美国46个州,为美国国内创造就业岗位超过14万个,而且大部分为制造业岗位。 |

| Trade and economic cooperation has brought real benefits to American consumers. Bilateral trade provides consumers with a broad range of choices, lowers their living costs, and raises the real purchasing power of the American people, especially the low- and middle-income cohort. According to the US-China Business Council, in 2015, trade with China saved every American family US$850 of expenditure each year, which is equivalent to 1.5% of the average household income in the US. | | 给美国消费者带来了实实在在的好处。双边贸易丰富了消费者选择,降低了生活成本,提高了美国民众特别是中低收入群体实际购买力。美中贸易全国委员会研究显示,2015年,中美贸易平均每年为每个美国家庭节省850美元成本,相当于美国家庭收入的1.5%。 |

| Trade and economic cooperation has created a large number of business opportunities and significant profits for American businesses. With China being a huge and rapidly growing market, trade and economic cooperation between China and the US has created huge business opportunities for American businesses. From the trade perspective, the US-China Business Council 2017 State Export Report found that in 2017, China was one of the top five export markets of goods for 46 states. In 2016 China was one of the top five export markets of services for all 50 states. On average every US farmer exported over US$10,000 of agricultural products to China in 2017. From the investment perspective, according to MOFCOM, in 2015 US firms in China realized approximately US$517 billion of sales revenue and over US$36 billion of profits; in 2016, their sales reached about US$606.8 billion and profits exceeded US$39 billion. For the top three US automakers, their joint ventures in China made a total profit of US$7.44 billion in 2017. In the same year, a total of 3.04 million American passenger vehicles were sold in China, accounting for 12.3% of all passenger vehicles sold in China . General Motors alone has ten joint ventures in China. Its output in China accounted for 40% of its global output. Qualcomm's income from chip sales and patent royalties in China accounted for 57% of its total revenue. Intel's revenues in China (including the Hong Kong region) accounted for 23.6% of its total revenue. In the FY 2017, revenues from Greater China accounted for 19.5% of the Apple Inc. total. By January 2017, 13 American banks had subsidiaries or branches and ten American insurance companies had insurance firms in China. Goldman Sachs, American Express, Bank of America, Metlife and other American financial institutions have reaped handsome returns from their strategic investment in Chinese financial institutions. According to China Securities Regulatory Commission, American investment banks were lead underwriters or co-lead underwriters for 70% of the funds raised by Chinese companies in their overseas IPOs and refinancing. US law firms have set up about 120 offices in China. | | 为美国企业创造了大量商机和利润。中国是一个巨大而快速增长的市场,中美经贸合作为美国企业提供了大量商业机会。从贸易来看,根据美中贸易全国委员会发布的《2017年度美各州对华出口报告》,2017年中国是美国46个州的前五大货物出口市场之一,2016年中国是美国所有50个州的前五大服务出口市场之一;2017年每个美国农民平均向中国出口农产品1万美元以上。从投资来看,根据中国商务部统计,2015年美国企业实现在华销售收入约5170亿美元,利润超过360亿美元;2016年销售收入约6068亿美元,利润超过390亿美元。美国三大汽车制造商2015年在华合资企业利润合计达74.4亿美元。2017年美系乘用车在华销量达到304万辆,占中国乘用车销售总量的12.3%,仅通用汽车公司在华就有10家合资企业,在华产量占到其全球产量的40%。美国高通公司在华芯片销售和专利许可费收入占其总营收的57%,英特尔公司在中国(包括香港地区)营收占其总营收的23.6%。2017年财年,苹果公司大中华地区营收占其总营收的19.5%。截至2017年1月,13家美国银行在华设有分支机构,10家美资保险机构在华设有保险公司。高盛、运通、美国银行、美国大都会人寿等美国金融机构作为中国金融机构的战略投资者,均取得了不菲的投资收益。根据中国证监会统计,中国境内公司到境外首发上市和再融资,总筹资额的70%由美资投资银行担任主承销商或联席主承销商。美国律师事务所共设立驻华代表处约120家。 |

| Trade and economic cooperation has promoted industrial upgrading. In their trade and economic cooperation with China, US multinational companies have sharpened their international competitiveness by combining competitive factors of production in the two countries. For example, iPhones are designed in the US, manufactured and assembled in China, and sold in the world. According to a Goldman Sachs report in 2018, should Apple Inc. relocate all its production and assembly to the US, its product cost would increase by 37%. In technological cooperation, US companies which have sales and investment in China enjoy the benefits of cloud computing and artificial intelligence applied in China, so that American products can better adapt to the changing global market. By manufacturing for US companies, China has enabled the US to invest more money and resources in innovation and management, focus on high-end manufacturing and modern services, and upgrade its industry with more added-value and high technology. This has also helped the US in conserving energy and resources and mitigating pressure in environmental protection at home, making the US more competitive in the world. | | 促进了美国产业升级。在与中国经贸合作中,美国跨国公司通过整合两国要素优势提升了其国际竞争力。苹果公司在美国设计研发手机,在中国组装生产,在全球市场销售。根据高盛公司2018年的研究报告,如苹果公司将生产与组装全部移到美国,其生产成本将提高37%。从技术合作领域看,美国企业在中国销售和投资,使这些企业能够享受中国在云计算和人工智能等方面的应用成果,使其产品更好适应不断变化的全球市场。中国承接了美国企业的生产环节,使得美国能够将更多资金等要素资源投入创新和管理环节,集中力量发展高端制造业和现代服务业,带动产业向更高附加值、高技术含量领域升级,降低了美国国内能源资源消耗和环境保护的压力,提升了国家整体竞争力。 |

| In general, China-US trade and economic cooperation is a win-win relationship and by no means a zero-sum game, bringing concrete benefits to US companies and people. Some Americans claim that the United States is “losing” in this relationship, a claim which does not stand up to scrutiny. | | 总体来看,中美经贸合作是一种双赢关系,绝非零和博弈,美国企业和国民从中得到了实实在在的好处,美国一部分人宣称的“美国吃亏论”是站不住脚的。 |

| II. Clarifications of the facts about China-US trade and economic cooperation | | 二、中美经贸关系的事实 |

| Economic cooperation and trade between the two countries is so huge, substantive and broad-based, with so many players, that it is inevitable for some differences and friction to emerge. The two countries need to take a comprehensive perspective, keep in mind their strategic interests and the international order, properly handle their differences by seeking common ground while shelving differences, and take practical steps to resolve their tensions. However, in its Section 301 report and other ways, the current US administration stigmatizes China by accusing it of “economic aggression”, “unfair trade”, “IPR theft” and “national capitalism”. This is a gross distortion of the facts in China-US trade and economic cooperation. It turns a blind eye to the huge progress in China's reform and opening-up as well as the dedication and hard work of the Chinese people. This is disrespectful to the Chinese government and people as well as incompatible with the real interests of the American people. It will only aggravate differences and tensions, which in the end will damage the fundamental interests of both countries. | | 中美经贸交往规模庞大、内涵丰富、覆盖面广、涉及主体多元,产生一些矛盾分歧在所难免。两国应以全局综合的视角看待,从维护两国战略利益和国际秩序大局出发,以求同存异的态度妥善处理分歧,务实化解矛盾。但是,现任美国政府通过发布《对华301调查报告》等方式,对中国作出“经济侵略”、“不公平贸易”、“盗窃知识产权”、“国家资本主义”等一系列污名化指责,严重歪曲了中美经贸关系的事实,无视中国改革开放的巨大成绩和中国人民为此付出的心血汗水,这既是对中国政府和中国人民的不尊重,也是对美国人民真实利益的不尊重,只会导致分歧加大、摩擦升级,最终损害双方根本利益。 |

| 1. The gap in trade in goods alone is not a good indicator of China-US trade and economic cooperation. | | (一)不应仅看货物贸易差额片面评判中美经贸关系得失 |

| An objective understanding and assessment of China-US trade balance calls for comprehensive and in-depth study, rather than a glance at the trade deficit in goods. It is not China's intention to have a trade surplus. Rather, the ratio of China's current account surplus to its GDP has declined from 11.3% in 2007 to 1.3% in 2017. The imbalance of trade in goods between China and the US is more of a natural outcome of voluntary choices the US has made in economic structure and market in the light of its comparative strengths. To resolve this issue, both sides need to make concerted efforts in restructuring. The United States turns a blind eye to various factors in its trade and economic cooperation with China, singles out the imbalance of trade in goods, and blames China for the imbalance, which is unfair and unreasonable. | | 客观认识和评价中美双边贸易是否平衡,需要全面深入考察,不能只看货物贸易差额。中国并不刻意追求贸易顺差,事实上,中国经常账户顺差与国内生产总值之比已由2007年的11.3%降至2017年的1.3%。中美货物贸易不平衡现象更多是美国经济结构和现有比较优势格局下市场自主选择的自然结果,解决这一问题需要双方共同努力进行结构性调整。美国无视影响中美经贸关系的多方面因素,片面强调两国货物贸易不平衡现象,将责任归咎于中国,是不公平、不合理的。 |

| China-US trade and economic cooperation delivers balanced benefits in general. The imbalance of trade in goods between the two countries has evolved over time. From the 1980s to early 1990s, the US ran a surplus in its trade with China; in 1992 China began to run surplus, which has continued to grow. | | 中美经贸往来获益大致平衡。中美双边货物贸易不平衡现象有一个历史演变过程。在上世纪80年代至90年代初期美国一直处于顺差地位,1992年之后中国转为顺差并持续增加。 |

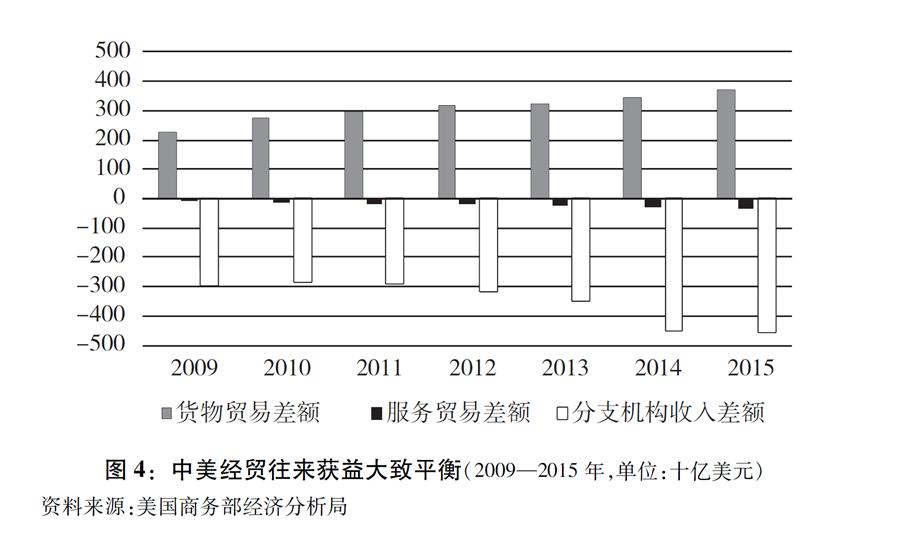

| In today's world of greater globalization and widespread international production, bilateral trade and economic cooperation already extend beyond trade in goods. Trade in services and sales of local subsidiaries in the host country (local sales in two-way investment) should also be included. If we give full consideration to these three factors—trade in goods, trade in services and sales of local subsidiaries in the host country, trade and economic cooperation delivers balanced benefits in general for China and the United States, with the latter reaping more net benefits. (See Chart 4)According to MOFCOM, the US ran a surplus of US$54.1 billion in trade in services in 2017, indicating its remarkable competitive strength in this area. According to the US Bureau of Economic Analysis (BEA), the sales of US companies in China reached US$481.4 billion in 2015, way higher than the US$25.6 billion sales of Chinese companies in the US, an advantage of US$455.8 billion. US companies enjoy an even bigger advantage in cross-border operations. In June 2018, Deutsche Bank released a report on calculating economic interests between the US and its major trading partners, arguing that, from the perspective of commercial interests, the US has in fact gained more commercial net benefits than China from their two-way trade, given the impact of global operations by multinational corporations on bilateral trade and economic cooperation. According to Deutsche Bank, after contributions from subsidiaries of third countries are taken away, the US enjoyed net benefits of US$20.3 billion in 2017. | | 在经济全球化深入发展、国际化生产普遍存在的今天,双边经贸关系内涵早已超出货物贸易,服务贸易和本国企业在对方国家分支机构的本地销售额(即双向投资中的本地销售)也应考虑进来。综合考虑货物贸易、服务贸易和本国企业在对方国家分支机构的本地销售额三项因素,中美双方经贸往来获益大致平衡,而且美方净收益占优(图4)。根据中国商务部统计,2017年美国对华服务贸易顺差为541亿美元,美国在服务贸易方面占有显著优势。根据美国商务部经济分析局数据,2015年美资企业在华销售额高达4814亿美元,远高于中资企业在美256亿美元的销售额,美国占有4558亿美元的优势,美国企业跨国经营优势更为突出。2018年6月德意志银行发布的研究报告《估算美国和主要贸易伙伴之间的经济利益》认为,从商业利益角度分析,考虑到跨国公司的全球经营对双边经贸交往的影响,美国实际上在中美双边贸易交往过程中获得了比中国更多的商业净利益。根据其计算,扣除各自出口中其他国家企业子公司的贡献等,2017年美国享有203亿美元的净利益。 |

| |  |

| Chart 4: China-US Trade and Economic Cooperation Delivers Balanced Benefits in General (2009-2015, unit: US$1 billion) | | 图表:图4:中美经贸往来获益大致平衡(2009-2015年,单位:十亿美元) 新华社发 |

The gap in China-US trade in goods is a natural outcome of the US economic structure, and a result of the two countries' comparative strengths and the international division of labor. The persistent and growing gap in trade in goods between the two countries is a result of a number of factors, rather than China's intent. | | 中美货物贸易差额是美国经济结构性问题的必然结果,也是由两国比较优势和国际分工格局决定的。中美双边货物贸易差额长期存在并不断扩大,是多重客观因素共同作用的结果,并不是中国刻意追求的结果。 |

| | |

| First, it is a natural outcome of a low savings rate in the US. From the perspective of national accounts, the balance of a country's current account is decided by the relationship between savings and investment. The US economy is characterized by low savings and high consumption. Savings have been lower than investment for many years. In the first quarter of 2018, the US net national savings rate was as low as 1.8%. To balance its domestic economy, the US has to attract a large amount of foreign savings by trade deficit. This is the fundamental cause of the US trade deficit over the years. The US began to run trade deficits in its foreign trade in 1971, and by 2017 it was running trade deficits with 102 countries. The US trade deficit is an endogenous, structural and sustained economic phenomenon. The current trade deficit of the US with the rest of the world has shifted among its trading partners and resides with China for the time being. | | 第一,这是美国国内储蓄不足的必然结果。从国民经济核算角度看,一国经常项目是盈余还是赤字,取决于该国储蓄与投资的关系。美国经济的典型特征是低储蓄、高消费,储蓄长期低于投资,2018年第一季度,美国净国民储蓄率仅为1.8%。为了平衡国内经济,美国不得不通过贸易赤字形式大量利用外国储蓄,这是美国贸易逆差形成并长期存在的根本原因。自1971年以来,美国总体上处于贸易逆差状态,2017年与102个国家存在贸易逆差。美国贸易逆差是一种内生性、结构性、持续性的经济现象。美国目前对中国的贸易逆差,只是美国对全球贸易逆差的阶段性、国别性反映。 |

| Second, it is a fair reflection of the complementarity and comparative strengths of Chinese and US industries. In terms of trade mix, China's trade surplus with the US mainly comes from labor-intensive products and manufactured goods, and its trade deficit with the US lies in capital- and technology-intensive products such as aircraft, integrated circuits, and automobiles, as well as agricultural products. In 2017, China ran a US$16.4 billion trade deficit with the US in agricultural products, accounting for 33% of China's total trade deficit in the agricultural sector; a US$12.75 billion trade deficit with the US in aircraft, accounting for 60% of China's total trade deficit in this sector; China also ran a US$11.7 billion deficit in automobile trade with the US. Therefore, the imbalance in trade in goods is a result of voluntary market choices where both countries have played to their industrial competitive strengths. | | 第二,这是中美产业比较优势互补的客观反映。从双边贸易结构看,中国顺差主要来源于劳动密集型产品和制成品,而在飞机、集成电路、汽车等资本与技术密集型产品和农产品领域都是逆差。2017年,中国对美农产品贸易逆差为164亿美元,占中国农产品贸易逆差总额的33%;飞机贸易逆差为127.5亿美元,占中国飞机贸易逆差总额的60%;汽车贸易逆差为117亿美元。因此,中美货物贸易不平衡是双方发挥各自产业竞争优势的情况下市场自主选择的结果。 |

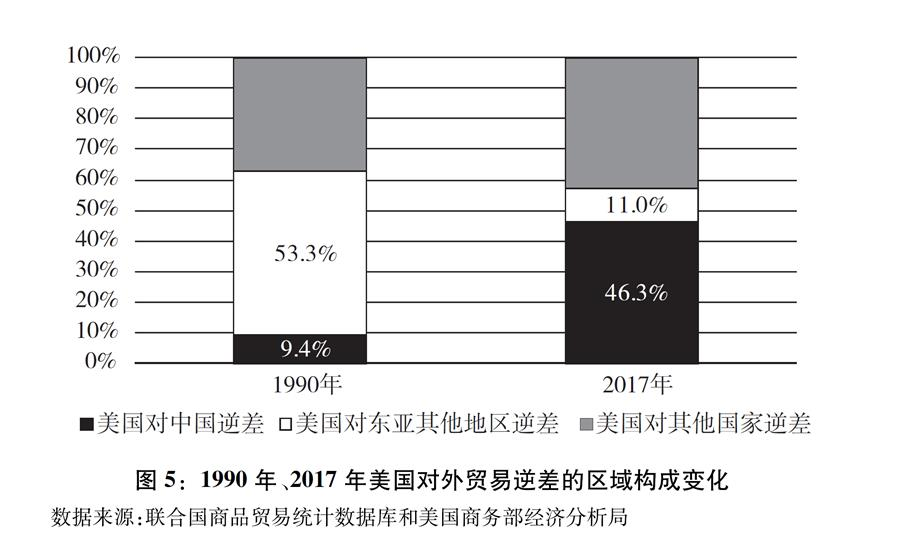

| Third, it is a result of the international division of labor and the changing configuration of production locations by multinational companies. As the global value chain and international division of labor expand, multinational companies have come to establish factories in China to assemble and manufacture products and sell them to the US and the global market, thanks to China's low production costs, strength in auxiliary production, and reliable infrastructure. When it comes to players in foreign trade, according to China Customs, 59% of China's trade surplus with the US was contributed by foreign-invested enterprises in China in 2017. In the process of receiving international industrial relocation and joining the Asia-Pacific industrial network, China has, to a large extent, taken over the trade surpluses of Japan, the ROK and other East Asian economies with the US. According to US BEA, the shares of Japan, the ROK and other East Asian Economies in the total US trade deficit have declined from 53.3% in 1990 to 11% in 2017, while China's trade surplus with the US has risen from 9.4% to 46.3% in the same period. (Chart 5) | | 第三,这是国际分工和跨国公司生产布局变化的结果。随着全球价值链和国际分工深入发展,跨国公司利用中国生产成本低、配套生产能力强、基础设施条件好等优势,来华投资设厂组装制造产品,销往包括美国在内的全球市场。从贸易主体看,据中国海关统计,2017年中国对美货物贸易顺差的59%来自外商投资企业。随着中国承接国际产业转移和融入亚太生产网络,中国在很大程度上承接了过去日本、韩国等其他东亚经济体对美的贸易顺差。据美国商务部经济分析局统计,日本、韩国等东亚经济体占美国总逆差的比值,由1990年的53.3%下降为2017年的11%,同期中国对美贸易顺差的占比则由9.4%上升为46.3%(图5)。 |

| |  |

| Chart 5: How the Regional Components of US Foreign Trade Deficit Changed (1990-2017) | | 图表:图5:1990年、2017年美国对外贸易逆差的区域构成变化 新华社发 |

| | |

| Fourth, this is the consequence of US export control over high-tech products exported to China. The US boasts huge competitive strength in high-tech trade. Yet, haunted by the cold-war mentality, it imposes strict export controls on China, thereby limiting the potential of advantageous US exports, causing significant lost export opportunities, and widening its trade deficit with China. According to a report by the Carnegie Endowment for International Peace in April 2017 , if US export controls on China were relaxed to the level of those on Brazil, its deficit could be cut by 24%, and 35% if relaxed to the level of France. Evidently there remains a huge potential to be tapped in high-tech exports to China. If the US had not itself closed the door, it could well have seen its trade deficit reduced. | | 第四,这是美国对华高技术产品出口管制的结果。美国在高新技术产品贸易方面拥有巨大竞争优势,但美国政府基于冷战思维,长期对华实施严格的出口管制,人为抑制了美国优势产品对华出口潜力,造成美企业丧失大量对华出口机会,加大了中美货物贸易逆差。据美国卡内基国际和平基金会2017年4月的报告分析,美国若将对华出口管制放松至对巴西的水平,美国对华贸易逆差可缩减24%;如果放松至对法国的水平,美国对华贸易逆差可缩减35%。由此可见,美国高技术产品对华出口的潜力远未充分发挥,美国不是不可以减少对华贸易逆差,只是自己关闭了增加对华出口的大门。 |

| | |

| Fifth, this is the result of the US dollar being a major global currency. The Bretton Woods system established after WWII was based on the US dollar. On the one hand, the US uses its “exorbitant privilege” to levy seignorage on all countries. For the US the cost for printing a hundred-dollar bill is no more than a few cents, but other countries will have to provide real goods and services in exchange for that note. On the other hand, as a major global currency, the US dollar supports global trade settlements, and the US supplies US dollars to the world by way of a deficit. Therefore, beneath the US trade deficit lie profound US interests and the very root of the international currency system. | | 第五,这是美元作为主要国际货币的结果。二战结束后确立了以美元为中心的布雷顿森林体系,一方面,美国利用美元“嚣张的特权”向世界各国征收“铸币税”,美国印制一张百元美钞的成本不过区区几美分,但其他国家为获得这张美钞必须提供价值相当于100美元的实实在在的商品和服务。另一方面,美元作为主要国际货币客观上需要承担为国际贸易提供清偿能力的职能,美国通过逆差不断输出美元。美国贸易逆差背后有其深刻的利益基础和国际货币制度根源。 |

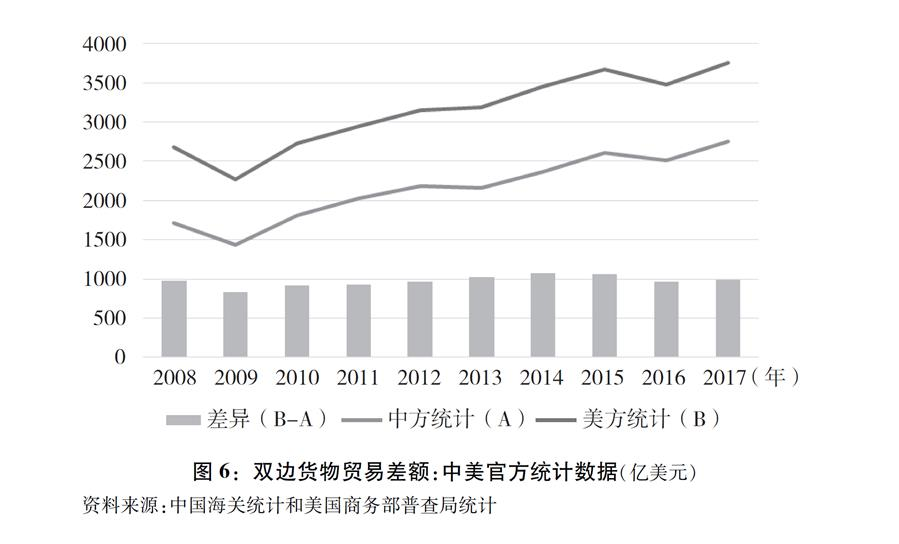

| In addition, US statistics exaggerate its deficit in trade in goods with China. There has been a significant and long-standing statistical divergence between China and the US. In 2017, Chinese statistics recorded a Chinese surplus of US$275.8 billion, while US statistics showed it to be US$395.8 billion, a gap of about US$100 billion. The statistical working group comprising experts from the USDOC and MOFCOM compare every year the statistics from China and the US, and estimate that the US statistics overstate the trade deficit with China by 20% every year. According to statistics from China Customs and the USDOC, the dynamics of and gap between the two statistics have been largely the same over the past decade.(Chart 6) Causes for divergence include differences between CIF and FOB prices, transit trade value-added, direct trade markup, geographical jurisdiction, and shipping time delay. | | 此外,美国统计方法相对高估了中美货物贸易逆差额。中美双方的统计差异长期存在,且差异较大。2017年,中国统计对美货物贸易顺差为2758亿美元,美国统计对华逆差接近3958亿美元,相差1000亿美元左右。由中美两国商务部相关专家组成的统计工作组,每年就中美贸易统计差异进行一次比较研究。根据该工作组测算,美国官方统计的对华贸易逆差每年都被高估20%左右。根据中国海关和美国商务部普查局的统计,双方统计结果在最近十年来的走势和变动幅度大致相同(图6)。引起差异的原因包括进口价格和出口价格之间的差异、转口贸易增值、直接贸易加价、地理辖区、运输时滞等。 |

| |  |

| Chart 6:Bilateral Goods Deficit: China and US Statistics (US$100 million) | | 图表:图6:双边货物贸易差额:中美官方统计数据(亿美元) 新华社发 |

If calculated by value added, the deficit would decrease significantly. China's foreign trade is characterized by large-scale imports and large-scale exports in processing, which applies to its trade with the US as well. According to MOFCOM, by trade methods, 61% of the China-US trade imbalance comes from processing. The value added in China accounts for only a small portion of the total value of many products, while the current approach is to calculate an export by aggregate (total value of goods exported). The WTO and the OECD started to advocate in 2011 a global perspective on production, and proposed to analyze the roles and benefits of all countries participating in the global distribution of labor by the approach of value-added accounting, for which the database WIOD was established. As an example, in 2016 conventional statistics show China's surplus with the US to be US$250.7 billion. Based on the WIOD database and using the value-added approach, this would become US$139.4 billion, a 44.4% decrease from the aggregate approach. | | 若以贸易增加值方法核算,美国对华逆差将大幅下降。中国对外贸易具有大进大出特点,中美贸易亦是如此。据中国商务部统计,从贸易方式看,中美贸易不平衡的61%来自加工贸易。中国在很多加工制成品出口中获得的增加值,仅占商品总价值的一小部分,而当前贸易统计方法是以总值(中国对美出口的商品全额)计算中国出口。世贸组织和经合组织等从2011年起倡导以“全球制造”新视角看待国际化生产,提出以“贸易增加值核算”方法分析各国参与国际分工的实际地位和收益,并建立了世界投入产出数据库。以2016年为例,据中国海关按照传统贸易总值的统计,中国对美顺差额为2507亿美元;但若根据世界投入产出数据库,从贸易增加值角度核算,中国对美贸易顺差为1394亿美元,较总值方法减少44.4%。 |

| | |

| 2. The discussion of fair trade should not be detached from the principle of mutual benefit of the WTO | | (二)不应脱离世界贸易组织的互惠互利原则谈论公平贸易 |

| In recent years, the US has turned away from “free trade” to advocating so-called “fair trade”, to which it has added new meanings. Unlike previous administrations, the incumbent administration emphasizes a “fair trade” that is not based on international rules but “America first”, or the protection of America's own interests. The core is so-called “reciprocal” opening, an idea of absolute equality, believing that all countries should apply identical tariff levels and provide identical market access in all sectors in their dealings with the US. In the eyes of the US government, the lack of reciprocity in market opening in other markets puts the US in an unfair position, and leads to bilateral trade imbalances. Such a concept of reciprocity is inconsistent with the reciprocal and mutually advantageous principle of the WTO. | | 近年来,美国从倡导“自由贸易”转向强调所谓“公平贸易”,并赋予其新解释。现任美国政府强调的所谓“公平贸易”不是基于国际规则,而是以“美国优先”为前提,以维护美国自身利益为目标。其核心是所谓“对等”开放,即各国在每个具体产品的关税水平和每个具体行业的市场准入上都与美国完全一致,寻求绝对对等。在美国政府看来,美国与其他国家市场开放“不对等”使美国处于不公平的贸易地位,并导致双边贸易不平衡。这种对等概念,与世界贸易组织的互惠互利原则并不一致。 |

| The principle of reciprocity of the WTO takes into consideration different development stages by granting special and differential and more favorable treatment to developing members. This arrangement aims to attract new developing members, increase the WTO's representation and enhance the inclusiveness of the multilateral system, while respecting the right to develop of developing countries and regions. It enshrines the principle of mutual benefit in exchanging present favors for future opening. Developing members that are in the initial stage of development need appropriate protection for their industries to promote sound growth, which will provide more opportunities for developed countries in time. This differential and more favorable treatment is in the long-term interests of all countries and regions, including developed members, and this is genuine global fairness. In 2001, China joined the WTO as a developing member and has been treated as such. It still remains a developing country even after more than a decade of rapid economic development. China's large population of 1.39 billion dilutes massive economic figures to low levels on a per capita basis. According to IMF statistics, in 2017 the per capita GDP of China was US$8,643, only 14.5% of that of the US, and ranking 71st in the world. By the end of 2017 there were still 30.46 million rural people living in poverty. It is unfair to demand absolute equality in tariffs between China and the US simply on the grounds of China's economic aggregate and trade volume. The absolute equality approach also violates the MFN and non-discrimination principles of the WTO (Box 1). | | 世界贸易组织所提倡的互惠互利原则,考虑了各国发展阶段的差别。在世界贸易组织框架下,发展中成员享有差别和更优惠待遇。这种制度安排是在尊重发展中国家和地区发展权的基础上,积极吸纳新的发展中成员加入,以扩大成员数量、增强多边体制的包容性,也体现了以当期优惠换取后期开放的互惠原则。对于发展中成员而言,由于其处于发展初期阶段,需要对产业适度保护以促进良性发展,其市场随经济发展扩大后,也将为发达国家带来更多商业机会。发展中成员享有差别和更优惠待遇,符合包括发达成员在内的各国各地区长期利益,这种制度安排是真正意义上的国际公平。2001年,中国通过多边谈判以发展中成员身份加入世界贸易组织,享受发展中成员待遇。十几年来,中国经济实现了快速发展,但仍然是一个发展中国家。由于中国有13.9亿人口,经济总量数据显得较为庞大,但这没有改变人均发展水平较低的现实。根据国际货币基金组织数据,2017年中国人均国内生产总值8643美元,仅为美国的14.5%,排在世界第71位。2017年末中国还有3046万农村贫困人口。仅以中国经济和贸易总规模较大为依据,要求中国和美国实现关税绝对对等是不合理的。美国追求绝对对等的做法,违背了世界贸易组织最惠国待遇和非歧视性原则(专栏1)。 |

Box 1 So-called Reciprocal Opening is not in Line with the Non-Discrimination Principle of the WTO In the WTO, the reciprocal and mutually advantageous principle (including most-favored nation treatment and national treatment) and the non-discrimination principle are closely linked. The preambles of the Marrakesh Agreement Establishing the World Trade Organization and GATT 1994mention “reciprocal and mutually advantageous arrangements directed to the substantial reduction of tariffs and other barriers to trade and to the elimination of discriminatory treatment in international trade relations”. At its heart is providing MFN treatment to all WTO members and not arbitrarily discriminating against other WTO members. But it is often prone to misunderstanding or abuse, incompatible with the MFN treatment on many occasions and prone to become an excuse for discriminatory treatment. On February 12th, 2018, the US announced for the first time that it was considering reciprocal tariffs on certain products coming into the US, the same as those imposed by the counterpart on the import of the same products from the US. By insisting on absolute equality in treatment regarding a certain product, this idea of reciprocity distorts the mutual benefit principle. The WTO-defined “reciprocal” and the so-called “reciprocal” of the US have different meanings. If reciprocal tariffs were to be implemented on a large scale, it would lead to different tariffs for different countries, deviating from the MFN treatment. And if reciprocal tariffs are imposed on a small number of countries with high tariff rates, it would be tantamount to the US withholding MFN treatment towards these countries. |

Box 1 So-called Reciprocal Opening is not in Line with the Non-Discrimination Principle of the WTO

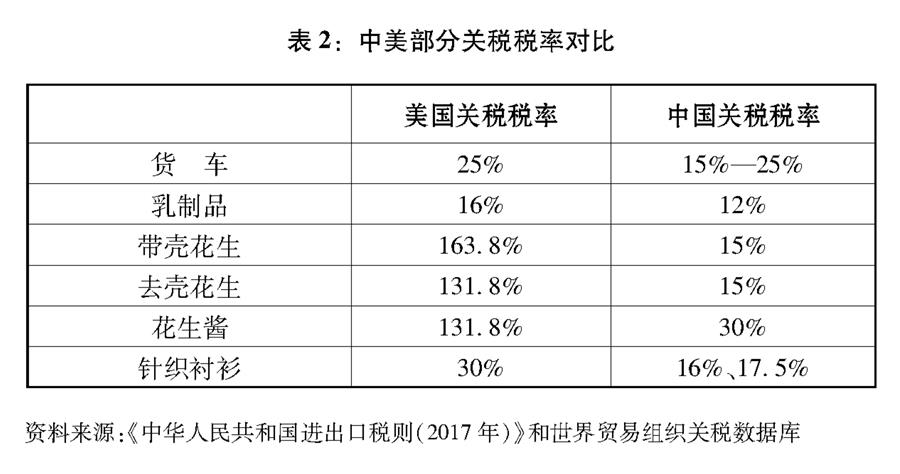

The reciprocity and mutual benefit principle advocated by the WTO means overall reciprocity and balance of interests in market opening across all the industries of the members, rather than narrowly defined reciprocity of treatment for a specific industry or product. Given the differences in endowment and competitiveness, absolutely reciprocal opening would be virtually impossible, and tariffs in different industries diverge. Even if we follow this absolute reciprocity logic of the US, unfair and non-reciprocal practices are more than common in the US. For example, China's tariffs on peanuts in the shell, dairy products and trucks are 15%, 12% and 15-25% respectively, while WTO tariff figures show those of the US to be 163.8%, 16% and 25%, all higher than China. (Table 2)

| US | China | Trucks | 25% | 15-25% | Dairy Products | 16% | 12% | Peanuts in the Shell | 163.8% | 15% | Shelled Peanuts | 131.8% | 15% | Peanut Butter | 131.8% | 30% | Knitted Shirts | 30% | 16%, 17.5% |

Table 2:Some Tariffs in China and in the US

China, having fulfilled its WTO commitments, has voluntarily engaged in unilateral tariff reductions to expand market opening. By 2010, all commitments in goods had been fulfilled, with the overall tariff level decreased from 15.3% in 2001 to 9.8%. Yet China did not limit itself to WTO commitments; it has promoted trade and investment liberalization through FTAs, given special treatment in tariffs to LDCs, and significantly reduced import tariffs using provisional tariffs on several occasions. According to the WTO, China's weighted tariff in 2015 had fallen to 4.4%, significantly lower than that of emerging economies and developing countries such as the Republic of Korea, India and Indonesia, approaching that of the US (2.4%) and the EU (3%). China's tariffs on agricultural products are lower than the real tariffs of Japan, and lower than those of Australia for non-agricultural goods (Table 3). From the beginning of 2018, China further voluntarily cut the MFN rate on whole vehicles to 15%, and the MFN rate on auto parts from a maximum 25% to 6%. China has reduced import tariffs for 1,449 daily necessities, with the MFN rate down by an average of 55.9%from 15.7% to 6.9%. Currently, China's overall tariff rate has been reduced to 8%.

| All | Agro Products | Non-agro Products | Japan | 2.1 | 11.1 | 1.2 | The United States | 2.4 | 3.8 | 2.3 | The European Union | 3.0 | 7.8 | 2.6 | Australia | 4.0 | 2.4 | 4.1 | China | 4.4 | 9.7 | 4.0 | Republic of Korea | 6.9 | 55.4 | 4.0 | Indonesia | 6.8 | 7.8 | 6.7 | India | 7.6 | 38.0 | 5.6 |

Table 3: Trade Weighted Average Tariff Rates of China and Other Countries (%)

The idea of “fair trade” and “reciprocal opening up” advocated by the US ignores the existence of objective differences among countries in terms of stage of development, resources, and competitive industries, and ignores developing countries' right to develop. It will create an impact on the economy and industries of the developing countries, result in broader inequality, and eventually prevent American businesses from expanding their international market share and sharing development opportunities in the developing countries.

Since its accession to the WTO, China has made important contribution to world economic development. Some people think China has taken advantage of its WTO membership while putting other countries at a disadvantage. In fact, after China joined the WTO, it has provided international capital and technologies with low-cost labor and land resources, generating immense production capacity that has promoted the development of global industrial chain and value chain, and world economic growth. In this process, FDI to China has kept on growing, surging from USD46.88 billion in 2001 to USD136.32 billion in 2017, at an annual growth of 6.9%. Multinationals have shared the immense opportunities in China's economic development. In the meantime, China has paid a high cost in environment and industrial restructuring as its economy grows rapidly. | |  |

3. China should not be accused of forced technology transfer as it is against the spirit of contract

Since the adoption of reform and opening up, foreign enterprises have established partnerships with Chinese companies by voluntarily entering into contracts. They transferred production capacity and orders to China of their own volition so as to tap into the emerging market, save production costs, achieve economy of scale, and extend the term of profiting from technologies. These are voluntary behaviors based on business interests. However, it accords with neither historical facts nor the spirit of contract to unjustly label bilateral transactions on a voluntary basis as forced technology transfer simply on the grounds of Chinese firms' technological advances.

Technology transfer in the course of cooperation between China and developed countries such as the US is voluntary technology transfer and industrial transfer initiated by the enterprises of developed countries keen to maximize their interests. The product life-cycle theory indicates that any kind of product goes through a life-cycle from peak to decline due to application of new technologies. While endeavoring to develop new technologies, multinationals continuously transfer technologies that are either obsolete or standardized to developing countries with a view to extending the term of profiting from old technologies, making room and sparing production factors for R&D and application of new ones, and indirectly sharing R&D costs. Therefore, technology transfer and licensing is a widely-used business cooperation model. Since the 1990s, Microsoft, Intel, Qualcomm, P&G, GE, Lucent, and other American companies have set up R&D facilities in China in a bid to better adapt to and explore the Chinese market. Over the years, American firms in China have earned handsome profits through technology transfer and licensing. They are the largest beneficiary of technological cooperation.

In the process of cooperation, the Chinese government has never introduced policies or practices that force foreign invested enterprises to transfer technology. Technological cooperation and other forms of commercial cooperation between Chinese and foreign businesses are entirely voluntary and bound by contracts. It generates real benefits for companies on both sides. Generally speaking, there are three patterns of technology-related revenues earned by foreign enterprises: (1) one-off transfer through settlement by an agreed price or discounted equity participation; (2) technology-related income that is included in the sales of equipment, components or products; and (3) technology licensing fees. For example a foreign enterprise with a technological advantage sells equipment to a Chinese company short of certain technologies related to the equipment. The Chinese company has to buy technical services and components from the equipment supplier multiple times in the long run. The Chinese company is willing to purchase some of the technologies from the foreign company for a one-off payment. Such requirements for technology transfer are normal price negotiations based on cost-benefit accounting. Such technology fee payments, be they in installments or in a lump-sum, are common practices in international commercial technology trading. It is a complete distortion of the facts that the US administration labels as forced technology transfer the voluntary behaviors of FIEs to partner with Chinese companies, transfer or license technologies, and reap profits together in Chinese market by entering into business contracts.

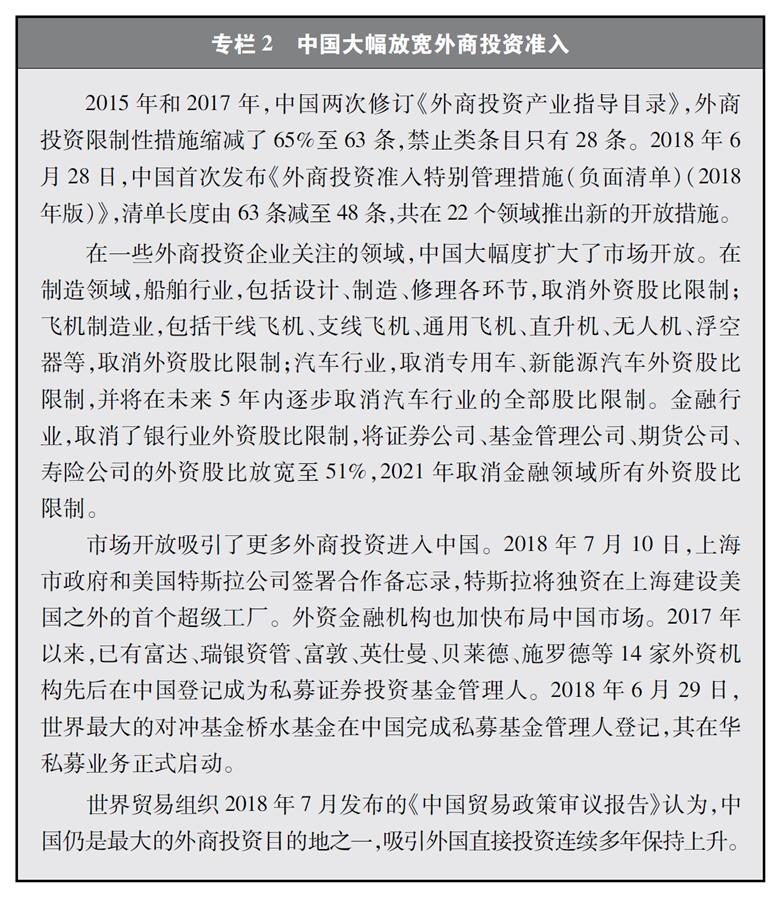

Besides, equity cooperation in some areas is in line with China's international obligations and usual practices of many countries, and does not constitute forced technology transfer either. In recent years, China has eased restrictions on foreign equity (See Box 2), and given foreign businesses greater freedom of choice. In this process, equity cooperation between Chinese and foreign enterprises becomes deeper as a result of free choices based on commercial considerations by the two sides.

Box 2 China markedly relaxes market access for foreign investment China revised the Catalogue for the Guidance of Foreign Investment Industries in 2015 and 2017. Restricted measures have been reduced by 65% to 63 items, and only 28 items are left under the prohibited category. On June 28, 2018, China for the first time published Special Administrative Measures for Foreign Investment Access (Negative List) 2018, reducing restrictions from 63 to 48, and introducing new opening up measures in 22 sectors. China has notably expanded market access in areas of interest to FIEs. In manufacturing, foreign equity caps will be lifted for the shipbuilding industry, including design, production and repair, and the airplane industry, including trunk airliners, regional jets, utility aircraft, helicopters, drones and lighter-than-air aircraft. In the automobile industry, China will remove foreign equity caps on manufacturing of special-purpose vehicles and new energy vehicles, and phase out those on all automotive ventures over the next five years. In the financial sector, China has lifted foreign equity caps for banks, and raised the cap to 51% for securities, fund management companies, futures and life insurers. All the foreign equity caps in finance will be removed by 2021. Market opening has attracted more foreign investment into China. On July 10, 2018, Shanghai Municipal government and Tesla signed a memorandum of cooperation which will allow Tesla to wholly own its first super factory built outside of the US, in Shanghai. Foreign financial institutions are also speeding up efforts to explore the Chinese market. Since 2017, 14 foreign institutions such as Fidelity, UBS Asset Management, Man Group, Fullerton, Blackrock, and Schroeder have registered as private securities investment fund managers in China. On June 29, 2018, the world's largest hedge fund manager, Bridgewater Associates LP, concluded its registration as a private fund manager in China and officially launched its private fund business in the market. The WTO noted in the report of trade policy review on China that the country remains one of the top foreign investment recipients and its inward FDI has kept rising for many years. |

Box 2 China markedly relaxes market access for foreign investment

That the US administration accuses China of “stealing” advanced technologies is an insult to China's efforts to push for scientific and technological advances. The Chinese nation is known for diligence, intelligence, and ingenuity. The Chinese government sets great store by the development of science, technology and education. The progress in science and technology China has made comes from years of implementing a strategy of invigorating the country through science, technology and education and the strategy of innovation-driven development, and from the hard work of the Chinese people, especially scientific workers. Since 2000, the total R&D spend in China has registered an average annual growth rate of close to 20%. In 2017, China spent RMB 1.76 trillion in R&D, second only to the US, accounting for 2.13% of total GDP, and approaching the average level of the OECD countries. China has 2,613 institutions of higher education, 10,900 research institutions of all sorts, and over 6.21 million people engaged in R&D. In 2017, the full-time equivalent of R&D personnel in China reached 4.03 million man-years, of which 77.3% were in enterprises. In the same year, China ranked third after the US and Japan with 113 Chinese enterprises listed among “The 2017 Global Innovation 1000”. According to the “Global Innovation Index 2018” released by WIPO in July 2018, China's ranking rose from 22ndin 2016 to 17thin 2018 . In 2017, patent applications reached 3.698 million in China, of which 1.836 million patents were granted. China's invention patent applications reached 1.382 million, up by 14.2% year-on-year, ranking 1stin the world for seven years in a row. According to WIPO statistics, China filed 49,000 international patent applications via the Patent Cooperation Treaty (PCT) in 2017, second only to the US. Among the top 50 international patent applicants, ten are Chinese enterprises. As former US Treasury Secretary and renowned American economist Larry Summers once said, “You ask me where China's technological progress is coming from. It's coming from terrific entrepreneurs who are getting the benefit of huge government investment in basic science. It's coming from an educational system that's privileging excellence, concentrating on science and technology. That's where their leadership is coming from, not from taking a stake in some US company.” | | 图表:专栏1 所谓“对等”开放不符合世界贸易组织非歧视性原则 新华社发 |

4. China's huge efforts and achievements with regard to IPR protection should not be dismissed.

China's attitude towards IPR protection is clear and firm. It has continued to reinforce protection through legislation, law enforcement and the judiciary, and achieved some notable successes. Official reports by the US administration before 2016 also acknowledged China's achievements in IPR protection. The China Business Climate Survey Reports by the American Chamber of Commerce in China indicate that, among the main challenges facing its member enterprises in China, IPR infringement has dropped from the 7thbiggest concern in 2011 to 12thin 2018. The recent accusations by the US administration about China's IPR protection are unrealistic and completely dismissive of China's tremendous efforts and achievements in this regard.

China has formulated and improved its laws and regulations on IP protection, and enhanced protection of IPR. China built a fully-fledged and high-standard IP legal framework in a relatively short period, compared to the decades or more that developed countries spent setting up similar legal systems. China has put in place a complete regime of IP protection, utilization and administration, spanning laws, planning, policies and enforcement agencies. Dr. Arpad Bogsch, former Director-General of the WIPO, has commented, “China had accomplished all this at a speed unmatched in the history of intellectual property protection.” In 2013, China amended its Trademark Law, setting up a system of punitive damages under which the damages cap is raised from RMB 500,000 to RMB 3 million, thus remarkably enhancing protection. Since the fourth major amendment to Patent Law launched in 2014, China has put forward measures for further strengthening protection of patents such as introducing harsher punishment for infringements, improving the rule of evidence, enhancing administrative protection, and better protecting patents in cyber space. In 2017, China amended the Anti-Unfair Competition Law, which further improves the protection of trade secrets, identifies act of confusion, expands the scope of protection for indications, and ratchets up legal liabilities for illegal acts. On October 1st, 2017, China adopted General Provisions of the Civil Law, which stipulates that “Civil entities enjoy intellectual property rights in accordance with law”, and enhances protection of trade secrets by making them a subject of IP protection.

China has intensified judicial protection for intellectual property and given full play to judicial protection. In 2014, China set up three IP tribunals in Beijing, Shanghai and Guangzhou to handle cross-regional IP cases, including those related to patents. Since 2009, China has established 16 special judicial organs in Tianjin, Nanjing, Suzhou, Wuhan, Xi'an and other cities, effectively enhancing the professional handling of IP cases. Between 2013 and 2017, Chinese courts received 813,564 new IP cases of all sorts, and handled and closed 781,257 cases. In 2017, Chinese courts received 213,480 first-instance cases, and concluded 202,970 cases, up by 46% and 43% from the previous year. More IP cases, especially patent cases, are tried in China than in any other country. China provides equal protection for the legitimate rights and interests of Chinese and foreign interested parties in accordance with law. In 2016, Chinese courts heard and closed 1,667 first-instance cases related to foreign entities and individuals, up by 25.6% year-on-year. (See Box 3) The adjudication period for foreign-related IP cases in China is among the shortest in the world. Beijing IP court processes cases in four months on average. Thanks to its rapid judicial procedure, China is increasingly being selected as the forum of choice for non-Chinese companies to litigate IP disputes, and a significant number of both the plaintiffs and defendants in Beijing IP court are foreigners.

Box 3 Chinese Courts Heard Foreign-related IP Cases in Accordance with Law Chinese courts have held open hearings on the “Qiaodan” trademark administrative dispute cases, the Dior trademark dispute cases, and other new types of major and problematic cases in accordance with law. The Supreme People's Court invited WIPO officers, foreign diplomats in China and relevant parties to observe the hearings. All this shows Chinese courts' commitment to offering equal protection to Chinese and foreign right holders' legitimate rights and interests in an open and transparent way, reinforcing judicial protection of IPR, and upholding a market environment that encourages innovation and fair competition. In 2013, the Shanghai Intermediate People's Court heard the trade secret misappropriation case lodged by Eli Lilly and Company and Lilly China against Huang Mengwei. The court issued an interlocutory injunction order requiring the defendant to stop infringement actions immediately. In its ruling, the court concluded that the defendant, whose behavior constituted trade secret misappropriation, should bear legal liabilities. |

Box 3 Chinese Courts Heard Foreign-related IP Cases in Accordance with Law

IP administrative authorities have taken protective measures and intensified enforcement in a proactive manner. China adopts a dual-track protection system where IP right holders can seek not only judicial but also administrative protection. The State Intellectual Property Office (SIPO) has established a coordinated system with rapid review, rapid rights verification, and rapid rights protection, and built a nationwide 12330 network that provides assistance in defending rights and accepting reports and complaints. The patent, trademark and copyright authorities have carried out strong and proactive enforcement that has effectively defended the legitimate interests of IP right holders. In November 2011, the State Council published Opinions on Further Cracking Down on IP Infringement and Manufacture and Sales of Counterfeit and Shoddy Products, setting up a national leading group and signaling a normalized mechanism involving 29 governmental departments. In 2018, China reorganized SIPO by retooling the trademark and patent enforcement teams into a comprehensive enforcement team for market regulation, thus integrating and strengthening the power of enforcement.

This intensified IP protection has served as an effective guarantee for foreign businesses to innovate in China. Received foreign invention patent applications grew from 117,464 in 2012 to 135,885 in 2017. Foreign trademark registration applications grew from 95,000 in 2013 to 142,000 in 2017, and trademark extension applications grew from 14,000 to 20,000 in the same period. According to the Peterson Institute, China's protection of intellectual property is improving. China's payment of licensing fees and royalties for the use of foreign technology has recorded a four-fold increase over the last decade, reaching US$28.6 billion in 2017 and ranking fourth in the world. In fact, China ranks second globally in the scale of licensing fees paid for technology used within its national borders, second only to the US.

US businesses have benefited hugely from effective IP protection in China. According to US Bureau of Economic Analysis of the DOC, China paid US$7.96 billion in licensing fees to the US in 2016. Statistics from China's National Copyright Administration, Ministry of Commerce, and State Administration for Market Regulation suggest that from 2012 to 2016, China imported 28,000 copyrights from the US. In terms of trademarks, from 2002 to 2016, the US applied for over 58,000 trademarks transfer in China, making up 4.54% of total transfers. In terms of culture, according to the State Administration of Press, Publication, Radio, Film, and TV, in 2017 China imported 31 American films at a cost of US$650 million.

China's progress in IP protection has been recognized by the international community. In 2011, China Customs won the National Public Body Award of the Global Anti-Counterfeiting Network. In 2012, the Economic Investigation Bureau of the Ministry of Public Security won the award for Distinguished Contributions to Anti-counterfeiting Enforcement. On 9 May 2011, former US president Obama stated that China had made good progress in IP protection. The US was willing to export more high-tech products to China and other countries in the interests of both sides. In February 2018, GIPC released a report on the International Intellectual Property Index 2018, which maps the national IP environment for 50 surveyed economies with 40 indicators. China ranked 25th, up by 2 places from 2017. | | 世界贸易组织所提倡的互惠互利原则,是各国就所有产业开放市场实现总体互惠和利益平衡,并非狭义局限于每个产业或产品承诺水平对等。由于资源禀赋、产业竞争力的差异,很难实现两个经济体绝对对等开放,不同产业关税水平是有差异的。如果按照美国绝对对等逻辑,美国自身也有大量不公平和不对等的情况。例如,中国对带壳花生、乳制品和货车征收的关税分别为15%、12%和15%-25%,而据世界贸易组织关税数据显示,美国相应的关税分别为163.8%、16%和25%,均高于中国(表2)。 |

5. The Chinese government's encouragement to Chinese business to go global should not be distorted as a government attempt to acquire advanced technologies through commercial M&A.

It is consistent with the WTO for the Chinese government to encourage businesses to go global and engage in international economic exchanges and cooperation. As Chinese companies get stronger and the need for resource allocation and market expansion increases, a growing number of firms have started to expand overseas at their own initiative, a trend in line with economic globalization. Like other countries and regions in the world, the Chinese government supports able and competent companies in outbound investment and tapping into international markets, while obeying the laws and regulations of the host countries as well as international rules. The government only provides services that facilitate this outbound investment and cooperation. The arbitrary conclusion of the US that such support is a government act to acquire advanced technologies through commercial M&A is groundless.

In fact, among Chinese investments in the US, those that seek to acquire technology represent a small share. According to the American Enterprise Institute, from 2005 to 2017, of 232 direct investments from China, only 17 involved high-technology, while others were mainly in real-estate, finance and services. | |  |

6. China's subsidy policy complies with WTO rules and should not be attacked.

China conscientiously complies with WTO rules on subsidy policy. As one of the tools to address market failure and imbalanced economic development, subsidies are widely used by many countries and regions, including the US. Since China joined the WTO, we have actively pressed ahead with reform to ensure the compliance of domestic policies, and conscientiously honored the obligations under the WTO Agreement on Subsidies and Countervailing Measures.

China complies with the WTO rules on subsidy transparency. As required, we have regularly notified the WTO of the revision, adjustment and implementation of our domestic laws, regulations and measures. By January 2018, China had submitted thousands of notifications, covering various areas of central and sub-national subsidy policies, agriculture, technical regulations, standards, and IP laws and regulations. In July 2016, in accordance with the relevant rules, the Chinese government notified the WTO of sub-national subsidy policies between 2001 and 2014, covering 100 subsidy policies from 19 provinces and 3 municipalities with independent planning authority. In July 2018 we notified the WTO of the central and sub-national subsidy policies between 2015 and 2016, covering all the provincial level administrative areas for the first time.

China has created a level playing field for the businesses. In recent years, the Chinese government has committed to transforming industrial policies. In June 2016 the State Council released Opinions on Establishing a Fair Competition Examination System in the Building of the Market System, setting out to guarantee rules-based government actions, prohibit new supportive measures that would exclude or impede competition, and filter out and abolish any existing rules and practices that hamper fair competition. In January 2017, the State Council released a Circular on Several Measures on Promoting Further Openness and Active Utilization of Foreign Investment, requiring authorities concerned to carry out a fair competition review in defining foreign investment policies. In June 2018, the State Council released a Circular on Certain Measures for Actively and Effectively Utilizing Foreign Investment to Promote Quality Economic Development, aiming to grant full pre-establishment national treatment on the basis of a negative list, and remove access restrictions on foreign investment in areas outside the list. As required by the Circular, to safeguard the legitimate rights and interests of foreign investors, China has improved the inter-departmental joint meeting mechanism for FIEs to lodge complaints, set up and enhanced the complaint mechanism for FIEs across the country, in order to promptly resolve any unfair treatment of FIEs, and avoid restrictions on the law-based cross-regional operation, movement and deregistration of FIEs.

China's agricultural industry has become increasingly market-based. In 2015, the NDRC announced the abolition of controlled pricing on tobacco leaves, marking the definitive end to government pricing for agricultural produce. Since 2004, on the basis of market-set price and free circulation, the Chinese government had stepped in to ensure the basic livelihood of farmers by adopting a government purchase system, a backstop in the case of severe oversupply and collapsing prices. In recent years, the Chinese government has stepped up efforts to reform the purchase system by introducing a more market-based price-setting mechanism. (Box 4)

Box 4 Reform of China's Agricultural Support Policies Based on the pilot reform between 2014 and 2016, in March 2017 the NDRC and the Ministry of Finance published the Notice on Deepening Reform of Cotton Target Price, adjusting the subsidy policy for Xinjiang cotton target prices and putting a cap on the volume of cotton that qualifies for target price subsidies. The target price-setting period was changed from once a year to once every three years, and thus the cotton subsidy has become a WTO blue box measure. While China still keeps the minimum purchase price policy for rice and wheat, it has steadily lowered the minimum price in recent years. At the same time, the Chinese government has stepped up the reform of fiscal payment subsidies and stressed the orientation toward green ecology. In May 2015, the Ministry of Finance and the Ministry of Agriculture published Guiding Opinions for Adjusting and Improving the Three Types of Agricultural Subsidies Policies. 80% of agricultural inputs, plus direct subsidy and improved varieties subsidy, are used for farmland protection. The remaining 20% of agricultural inputs plus large-scale farmers' direct subsidies and increments to the three subsidies are mainly used for establishing and improving the agricultural credit guarantee system. |

Box 4 Reform of China's Agricultural Support Policies | | 图表:表2:中美部分关税税率对比 新华社发 |

III. The trade protectionist practices of the US administration

The numerous investment and trade restriction policies and actions adopted by the US that distort market competition, hamper fair trade, and lead to breakdowns in global industrial chains are detrimental to the rules-based multilateral trading system and severely affect the normal development of China-US economic and trade relations. | | 事实上,中国在切实履行加入世界贸易组织承诺后,还主动通过单边降税扩大市场开放。截至2010年,中国货物降税承诺全部履行完毕,关税总水平由2001年的15.3%降至9.8%。中国并未止步于履行加入世界贸易组织承诺,而是通过签订自由贸易协定等方式推进贸易投资自由化,给予最不发达国家关税特殊优惠,多次以暂定税率方式大幅自主降低进口关税水平。根据世界贸易组织数据,2015年中国贸易加权平均关税税率已降至4.4%,明显低于韩国、印度、印度尼西亚等新兴经济体和发展中国家,已接近美国(2.4%)和欧盟(3%)的水平;在农产品和制成品方面,中国已分别低于日本农产品和澳大利亚非农产品的实际关税水平(表3)。2018年以来,中国进一步主动将汽车整车最惠国税率降至15%,将汽车零部件最惠国税率从最高25%降至6%;大范围降低部分日用消费品进口关税,涉及1449个税目,其最惠国平均税率从15.7%降至6.9%,平均降幅达55.9%。目前,中国关税总水平已进一步降为8%。 |

1. Discrimination against foreign products

Many American regulatory policies are clearly self-serving and protectionist as they run counter to the principle of fair competition and discriminate against foreign products. The US directly or indirectly restricts the purchase of products from other countries through legislation, subjecting foreign companies to unfair treatment in the US, with Chinese companies being the main victims.

The US product market falls behind most developed countries and even some developing countries in terms of fair competition. According to the statistics on Indicators of Product Market Regulation released by the OECD in 2013, the Netherlands, the UK and Australia were the top three among 35 OECD countries, while the US ranked only 27th, pointing to the many obstacles created by the US market regulatory policies for fair competition in the product market. When the indicators of 12 non-OECD countries were added, the US ranked only 30th among the 47 countries, indicating a product market environment less fair than those of non-OECD countries such as Lithuania, Bulgaria and Malta.

The US is far more discriminatory against foreign products than most developed countries and even some developing countries. According to the ranking of 35 OECD countries on Differential Treatment of Foreign Suppliers , a secondary indicator of the Indicators of Product Market Regulation, the US ranked 32nd among 35 OECD countries in 2013, indicating severe discrimination against foreign countries in its product market. When the indicators of 12 non-OECD countries were added, the US ranked 39th among the 47 countries, with a higher degree of discrimination than such non-OECD countries as Brazil, Bulgaria, Cyprus, India, Indonesia and Romania (Chart 7).

Chart 7: The Extent to Which US Market Regulatory Policies Inhibit Fair Competition in the Product Market

The US, by way of legislation, sets strict requirements on its government departments to “buy American” and imposes discriminatory terms on purchasing foreign products. For example, the Buy American Act stipulates that US federal agencies can only acquire manufactured products made in America and unmanufactured articles that have been mined or produced in America. According to the Code of Laws of the United States of America, an application for a public transport project receiving federal or state funding can be granted only if the steel, iron and manufactured goods used in the project are produced in the US. According to the Agriculture, Rural Development, Food and Drug Administration, and Related Agencies Appropriations Act, none of the funds made available by this Act may be used to procure raw or processed poultry products imported into the US from China for use in the school lunch program, the Child and Adult Care Food Program, the Summer Food Service Program for Children or the school breakfast program. The National Defense Authorization Act prohibits the federal government from procuring telecommunications equipment and services provided by Chinese companies on the grounds of national security.

| |  |

2. Abuse of “National Security Review” as a way to obstruct the normal investment activities of Chinese companies in the US

The US is the first in the world to conduct security reviews on foreign investment. In 1975, the Committee on Foreign Investment in the United States (CFIUS) was established for the specific purpose of monitoring the impact of foreign investment in the US. In 1988, the Exon-Florio Amendment revised the 1950 Defense Production Act by mandating the US President and people with the authority to review foreign takeovers. The Foreign Investment and National Security Act of 2007 expanded CFIUS and broadened its scope of review. The legislation process in the US over the past 50 years shows that the US security review of foreign investment has mainly been characterized by tighter laws, regulations and policies, expanded regulatory teams and scope of reviews, and more recently, intensified screening and restrictions vis-à-vis China.

In practice, the US “national security review” is often based on flimsy evidence and is becoming increasingly stringent. According to CFIUS annual reports to Congress, the Committee reviewed 468 foreign investment transactions from 2005 to 2008, only 37 of which (8 percent) entered the stage of investigation. However, since the Department of the Treasury issued the Regulations Pertaining to Mergers, Acquisitions, and Takeovers by Foreign Persons in 2008, among the 770 cases reviewed between 2009 and 2015, 310 cases – 40 percent of the total – passed on to the stage of investigation, which represents a noticeably sharp rise. In particular, the latest data released in 2015 shows this percentage climbing to an even higher level of 46 percent (Chart 8).

Chart 8 Statistics on Cases Reviewed and Investigated by CFIUS

Chinese companies are one of the main targets of the US abuse of national security reviews. Since the establishment of CFIUS, US Presidents vetoed four transactions based on the Committee's recommendation, all targeting Chinese firms or their related businesses. From 2013 to 2015, CFIUS reviewed in total 387 transactions concerning 39 economies, among which 74 were transactions involving investment from Chinese companies, accounting for 19 percent of the total, the largest share among all countries for three years in a row. The data on Chinese corporate investment being vetoed and blocked by the US (Table 4 and Table 5) shows that CFIUS review of Chinese investment has extended its reach from semiconductors and financial sectors to food processing sectors including swine feed. In addition to an absence of transparency in the review process, excessive discretionary power, and lack of explanations for vetoes, there is an even more serious issue – that normal transactions are being obstructed on the grounds of national security.