Resolution of the Third Session of the 12th National People's Congress on the Report on the Implementation of the Central and Local Budgets for 2014 and on the Drafts of the Central and Local Budgets for 2015 | | 第十二届全国人民代表大会第三次会议关于2014年中央和地方预算执行情况与2015年中央和地方预算的决议 |

| (Approved at the Third Session of the 12th National People's Congress on 15 March, 2015.) | | (2015年3月15日第十二届全国人民代表大会第三次会议通过) |

| The Third Session of the 12th National People's Congress reviewed the Report on the Implementation of the Central and Local Budgets for 2014 and on the Drafts of the Central and Local Budgets for 2015 proposed by the State Council and the Drafts of the Central and Local Budgets for 2015, and agreed the Report of the Review Result by the Financial and Economic Committee of the NPC. The session approved the Report on the Implementation of the Central and Local Budgets for 2014 and on the Drafts of the Central and Local Budgets for 2015, and the Central Budget for 2015. | | 第十二届全国人民代表大会第三次会议审查了国务院提出的《关于2014年中央和地方预算执行情况与2015年中央和地方预算草案的报告》及2015年中央和地方预算草案,同意全国人民代表大会财政经济委员会的审查结果报告。会议决定,批准《关于2014年中央和地方预算执行情况与2015年中央和地方预算草案的报告》,批准2015年中央预算。 |

| Tthe Report on the Implementation of the Central and Local Budgets for 2014 and on the Drafts of the Central and Local Budgets for 2015 | | 关于2014年中央和地方预算执行情况与2015年中央和地方预算草案的报告 |

| The Third Session of the 12th National People's Congress on 15 March, 2015 Ministry of Finance | | --2015年3月5日在第十二届全国人民代表大会第三次会议上 财政部 |

| Fellow Deputies, | | 各位代表: |

| The Ministry of Finance has been entrusted by the State Council to submit this report on the implementation of the central and local budgets for 2014 and on the drafts of the central and local budgets for 2015 to the Third Session of the Twelfth National People's Congress (NPC) for your deliberation and for comments from the members of the National Committee of the Chinese People's Political Consultative Conference (CPPCC). | | 受国务院委托,现将2014年中央和地方预算执行情况与2015年中央和地方预算草案提请十二届全国人大三次会议审议,并请全国政协各位委员提出意见。 |

| I. Implementation of the Central and Local Budgets for 2014 | | 一、2014年中央和地方预算执行情况 |

| Faced with a complex and changing international environment and formidable tasks of domestic reform, development, and stability in 2014, the Central Committee of the Communist Party of China (CPC) and the State Council have grasped the overarching trend of development, adhered to the general principle of seeking progress while keeping performance stable, deepened reform in all respects, continued to develop new ideas and methods for exercising regulation at the macro level, and effectively implemented proactive fiscal policy and prudent monetary policy. As a result, the economy has performed within an appropriate range, and development has become more balanced and sustainable. Both the central and local government budgets were well implemented. | | 2014年,面对复杂多变的国际环境和艰巨繁重的国内改革发展稳定任务,党中央、国务院牢牢把握发展大势,坚持稳中求进工作总基调,全面深化改革,继续创新宏观调控思路和方式,有效实施积极的财政政策和稳健的货币政策,经济运行处于合理区间,发展的协调性和可持续性增强。中央和地方预算执行情况良好。 |

| 1. Implementation of the NPC's budget resolution | | (一)落实全国人大预算决议情况。 |

| In accordance with the resolution of the Second Session of the Twelfth NPC on the report on both the implementation of the central and local budgets for 2013 and the central and local draft budgets for 2014 and the review of that report by the NPC's Financial and Economic Affairs Commission, we have deepened reform of the fiscal and tax systems, strengthened budgetary management, and made full use of the role of public finance. | | 按照十二届全国人大二次会议有关决议,以及全国人大财政经济委员会的审查意见,深化财税体制改革,加强预算管理,积极发挥财政职能作用。 |

| Major progress has been made in reforming the fiscal and tax systems. The overall plan for deepening reform of the fiscal and tax systems was deliberated over and passed at a meeting of the Political Bureau of the CPC Central Committee. First, substantive progress has been made in reforming the budget management system. We cooperated with the NPC on revising the Budget Law and saw the completion of its revision, and moved faster to revise the regulations on its enforcement. We issued the decision on deepening reform of the budget management system. We formulated the guidelines on carrying out medium-term fiscal planning, and began work on developing a national fiscal plan on a rolling three-year basis. We drew up the proposal on reforming and improving the system of transfer payments from the central to local governments and optimized the structure of payments, cutting the number of items receiving special transfer payments by over one third compared with the previous year and increasing transfer payments to old revolutionary base areas, areas with concentrations of ethnic minorities, and border areas by 12.1%. Second, systematic steps have been taken to reform the tax system. We further extended the trials to replace business tax with value added tax (VAT) to include, on a national scale, the railway transport, postal, and telecommunications industries. We drew up a plan for the reform of consumption tax and improved related policies. We implemented nationwide reform to levy a price-based resource tax on coal, adjusted the rates of resource tax on crude oil and natural gas, and cleared up and standardized administrative charges and government funds related to coal, crude oil, and natural gas. We cooperated with the work of the NPC on tax-related legislation, including preparatory work on legislation on environmental protection tax, and submitted to the NPC a suggested timetable for work on the implementation of the law-based taxation principle. Third, with a view to creating a better fit between government powers and spending responsibilities, we made a systematic review of how powers and expenditure responsibilities are allocated in mature market economies, researched into the current allocation of powers and spending responsibilities in sectors including national defense, public security, and food and drug regulation, and achieved initial results in our research on fiscal structural reform. In addition, we published the guidelines on improving and strengthening management of central government-funded research programs and their funding. We formulated a plan for deepening reform of the management of science and technology initiatives (projects and funds) financed by the central government, restructuring the system of management for such initiatives (projects and funds), dividing them into five categories, and gave impetus to the transformation of the government's functions of managing science and technology and the ways it exercises management. We carried out pilot reforms on management of the use and commoditization of and the distribution of profit from scientific and technological advances. We finished formulating the Regulations on the Enforcement of the Government Procurement Law. We drew up regulations for managing the government procurement of services and organized the launching of trials for governments to procure services. We also gave our support to reforms in state-owned enterprises (SOEs) and in the judicial, state capital, financial, and other important sectors. | | 财税体制改革取得重大进展。深化财税体制改革总体方案经中央政治局会议审议通过。一是预算管理制度改革取得实质性进展。配合完成了预算法修改工作,加快修订预算法实施条例。印发了深化预算管理制度改革的决定。制定了实行中期财政规划管理的意见,启动编制全国三年滚动财政规划。制定了改革和完善中央对地方转移支付制度的意见,优化转移支付结构,中央对地方专项转移支付项目比上年减少三分之一以上,革命老区、民族和边境地区转移支付增长12.1%。二是税制改革有序推进。进一步扩大营改增试点行业范围,将铁路运输、邮政和电信业在全国范围纳入试点。研究制订了消费税改革方案,完善了消费税政策。在全国实施煤炭资源税从价计征改革,调整原油、天然气资源税适用税率,同时清理规范涉及煤炭、原油、天然气的收费基金。配合全国人大积极推进环境保护税等立法工作。向全国人大报送了落实税收法定原则工作建议时间表。三是围绕建立事权和支出责任相适应的制度,系统梳理了成熟市场经济国家事权和支出责任划分情况,调研分析国防、公共安全、食品药品监管等领域的事权和支出责任划分,财政体制改革研究取得阶段性成果。同时,出台了改进加强中央财政科研项目和资金管理的若干意见;制定了深化中央财政科技计划(专项、基金等)管理改革的方案,按五大类重构中央财政科技计划(专项、基金等)体系,推动政府科技管理职能和组织管理方式转变;开展科技成果使用、处置和收益管理改革试点。完成政府采购法实施条例制定工作。制定了政府购买服务管理办法并组织开展试点。积极支持司法、国企国资、金融等其他重要领域的改革。 |

| Constraints on budgets were tightened. We worked diligently to implement NPC-approved budgets and maintain their authority. Despite a slowdown in the growth of government revenue and mounting pressure on expenditure, the deficit was kept at the same level as the figure budgeted in early 2014. We examined and approved the budgets of central government departments within the stipulated time frame, kept under strict control additional items in their budgets for which funds may be appropriated and the time frames within which such appropriations may be made, and reduced adjustments to departmental budgets. We sped up the process of making central government transfer payments available to local governments, shortening the time needed for general transfer payments from within 90 days to within 30 days of the approval of a budget. We improved the methods for evaluating the progress of implementation of budgetary expenditures by local governments, and promptly urged localities where spending had fallen behind schedule to speed up their implementation. We intensified efforts to develop an accurate picture of carryover and surplus funds, and launched ten specific policies and measures to make better use of available government funds. We thoroughly reviewed and standardized local governments' special accounts and closed approximately 12,000 accounts that ran counter to relevant regulations. | | 预算约束强化。认真执行全国人大批准的预算,维护预算的权威性。在财政收入增长放缓、支出压力加大的情况下,财政赤字与年初预算相当。在规定时限内批复中央部门预算,严格控制预算追加事项和追加时限,减少部门预算调整。加快中央对地方转移支付下达进度,一般性转移支付资金由批准预算后90日内下达缩短为30日内下达。完善地方预算支出进度考核办法,及时督促支出进度慢的地区加快执行。加强结转结余资金清理,出台了进一步盘活财政存量资金的十条具体政策措施。全面清理和规范地方财政专户,撤销不符合规定的地方财政专户约1.2万个。 |

| Fiscal and budgetary management was made more standardized. We reviewed and standardized preferential policies in taxation and other areas. The implementation of any preferential policy that was in breach of laws or regulations was, as of December 1, 2014, terminated without exception, while those that were retained after the review, along with any new preferential policies are all to be brought under permanent mechanisms and standardized management. We further standardized the management of budgets for government-managed funds, and established a mechanism for moving funds for which use should come under overall planning from the budgets of government-managed funds to the general public budgets. We improved management of state capital operations budgets and further raised the share of profits from the operations of central government enterprises turned over to the central government. Funds transferred from the budgets for central state capital operations to general public budgets were increased to 18.4 billion yuan from 6.5 billion yuan in 2013. The budgeting for national social security funds was included in the draft budget for the first time. | | 财政预算管理更加规范。清理规范税收等优惠政策,违法违规的优惠政策自2014年12月1日起一律停止执行,经过清理后保留的优惠政策以及今后新制定的优惠政策一律纳入长效机制、规范管理。进一步规范政府性基金预算管理,建立了将政府性基金预算中应统筹使用的资金列入一般公共预算的机制。完善国有资本经营预算管理,继续提高了中央企业国有资本收益收取比例。中央国有资本经营预算调入一般公共预算的资金规模由2013年的65亿元增加到184亿元。全国社会保险基金预算首次编入预算草案。 |

| Further improvements were made to the system for managing government debt. We introduced the guidelines on strengthening management of local government debt; established a standardized mechanism for local governments to secure financing through bond issuance; put into practice controls on the scale of local government debt, budgetary management, and early warning against risk; and established a local government debt management mechanism under which the borrowing, use, and repayment of funds are integrated. We worked to develop a clear picture of the outstanding debts of local governments. We formulated methods for assessing and giving early warnings on risks relating to local government debt. A total of 400 billion yuan worth of local government bonds were issued in 2014, and trials were successfully launched in ten regions for local governments to issue their own bonds and repay their own debts. We improved the system for managing the outstanding balance of government bonds, increased the types of bonds included within the trials of when-issued trading of government bonds, improved the mechanism for the periodic issuance and reissuance of government bonds of key terms, and for the first time, released the yield curves of key-term government bonds. We developed a reform plan to introduce a system for comprehensive government financial reporting based on accrual accounting, and clearly delineated the basic thinking on, major tasks for, concrete substance of, and steps for establishing such a system. We encouraged innovations in investment and financing mechanisms, and promoted the use of the public-private partnership (PPP) model, formulating guidelines on such partnerships and initiating projects that demonstrate how the model works in practice. | | 政府性债务管理制度进一步健全。出台了加强地方政府性债务管理的意见,明确建立规范的地方政府举债融资机制,对地方政府债务实行规模控制、预算管理和风险预警,建立“借、用、还”相统一的地方政府性债务管理机制。开展清理甄别地方政府存量债务工作。研究制定地方政府性债务风险评估预警等相关配套办法。2014年继续发行地方政府债券4000亿元,在10个地区顺利开展了地方政府债券自发自还试点。完善国债余额管理制度,扩大了国债预发行试点券种,健全了关键期限国债定期发行和续发机制,首次发布了关键期限国债收益率曲线。制定了权责发生制政府综合财务报告制度改革方案,明确了建立政府综合财务报告制度的总体思路、主要任务、具体内容和实施步骤等。推动投融资机制创新,推广运用政府和社会资本合作(PPP)模式,出台合作模式指南,开展项目示范。 |

| Financial discipline was strengthened. We intensified efforts nationwide to tighten up financial discipline and deal with unauthorized departmental coffers, and investigated and prosecuted all types of financial behavior in violation of the law or discipline. Irregularities to the sum of 140.6 billion yuan were discovered in areas including budgetary revenue and expenditure as well as government procurement, and 1,538 individuals were held to account. We strictly enforced the requirement that increases are not to be tolerated in spending on official overseas visits, official vehicles, and official hospitality, and that such spending should be cut. We reduced expenditures on meetings; put a stop to the use of official vehicles and office space by officials in excess of standards; and kept under strict control the construction of new government buildings, increases in the total number of government employees, and the use of government funds to host gala parties or other events. We basically completed the reform of the system for the use of official vehicles by agencies of the CPC Central Committee and the central government. We improved financial and accounting systems underpinning the Regulations on Practicing Thrift and Opposing Waste in Party and Government Bodies. Having basically achieved complete coverage of all budget-preparing departments at and above the county level with the centralized treasury payment system, we moved forward with the reform of town and township institutions according to their types. We pushed for the implementation of digital centralized treasury payment by all provincial-level finance departments. We actively promoted the system of listing items requiring procurement through government credit cards. We strengthened the development of mechanisms for dynamic monitoring of the implementation of budgets, with a focus on intensifying monitoring over spending on meetings, training, hospitality, and major programs. We redoubled efforts to ensure that budgets and final accounts are released to the public, increasing the number of central government departments that release their budgets and final accounts to 99 and adding into budgets and final accounts a table specifically showing government spending on official overseas visits, official vehicles, and official hospitality. The budgets and final accounts released by the central government and its departments were detailed down to the subsection level - the lowest level in the classification of functions of expenditure, and the budgets of special transfer payments released were detailed down to the specific project. Thirty-one provinces, autonomous regions, and municipalities directly under the central government released their general public budgets and the budgets of their departments. | | 财经纪律严肃性增强。在全国范围开展了严肃财经纪律和“小金库”专项治理工作,狠刹各种财经违纪违法行为,在预算收支、政府采购等方面查出问题金额1406亿元,已对1538人进行责任追究。严格执行“三公”经费只减不增的要求,减少会议费支出,清理超标公务用车和办公用房,从严控制政府性楼堂馆所建设和财政供养人员,严格控制使用财政资金举办文艺晚会等活动。基本完成中央和国家机关公务用车制度改革。完善《党政机关厉行节约反对浪费条例》财政财务配套制度体系。在国库集中支付制度改革已基本覆盖县级以上预算单位的基础上,推动乡镇分类实施改革。推进国库集中支付电子化管理在省级全面实施。积极推广公务卡强制结算目录制度。加强预算执行动态监控机制建设,重点加大对会议费、培训费、招待费、重大专项等资金的监控力度。加大预决算公开力度,公开预决算的中央部门增加到99个,专门增加了“三公”经费财政拨款预决算表。中央财政预决算和部门预决算公开到支出功能分类最底层的项级科目,专项转移支付预算公开到具体项目。31个省(自治区、直辖市)全部公开了本地区一般公共预算和本级部门预算。 |

| 2. Budgetary revenue and expenditure in 2014 | | (二)2014年预算收支情况。 |

| (1) General public budgets | | 1.一般公共预算。 |

| Revenue in the general public budgets nationwide totaled 14.034974 trillion yuan, an increase of 8.6% over 2013 (as below). Adding the 100 billion yuan from the Central Budget Stabilization Fund, utilized revenue totaled 14.134974 trillion yuan. Expenditure in the general public budgets nationwide amounted to 15.166154 trillion yuan, up 8.2%. Including the 219.52 billion yuan used to replenish the Central Budget Stabilization Fund and local budget stabilization funds and carried forward to the 2015 local budgets, and the 99.3 billion yuan used to repay the principal on local government bonds, expenditure totaled 15.484974 trillion yuan. Total expenditure therefore exceeded total revenue, leaving a deficit of 1.35 trillion yuan. | | 全国一般公共预算收入140349.74亿元,比2013年(下同)增长8.6%。加上从中央预算稳定调节基金调入1000亿元,使用的收入总量为141349.74亿元。全国一般公共预算支出151661.54亿元,增长8.2%。加上补充中央和地方预算稳定调节基金及地方财政结转下年支出2195.2亿元、地方政府债券还本支出993亿元,支出总量为154849.74亿元。收支总量相抵,赤字13500亿元。 |

| There was a further slowdown in the growth rate of revenue in the general public budgets nationwide. There were several reasons for this. First, downward pressure on the economy was great, and growth in indexes including industrial production, consumption, investment, and corporate profit demonstrated varying levels of decline, leading to slower growth in revenue from VAT, corporate income tax, and other major forms of tax. Second, the producer price index (PPI) was constantly falling, and the consumer price index (CPI) remained low, which had an impact on the growth of government revenue as calculated according to current prices. Third, policies to make adjustments to the real estate market grew in impact, and there was a steep decline in housing sales, leading to a significant slowdown in the growth of revenue from real estate business tax, corporate income tax from enterprises in the real estate industry, and deed transfer tax. In addition, expansion of the pilot scheme to replace business tax with VAT and implementation of other policies also led to certain reductions in government revenue. | | 全国一般公共预算收入增速进一步放缓。主要原因:一是经济下行压力较大,工业生产、消费、投资、企业利润等指标增幅均不同程度回落,增值税、企业所得税等主体税种收入增幅相应放缓。二是工业生产者出厂价格指数持续下降,消费者价格指数一直在低位徘徊,影响以现价计算的财政收入增长。三是房地产市场调整影响扩大,商品房销售额明显下滑,与之相关的房地产营业税、房地产企业所得税、契税等收入增幅回落较多。同时,扩大营改增试点范围等政策,减少了部分财政收入。 |

| Revenue in the central government's general public budget amounted to 6.449001 trillion yuan, 100.2% of the budgeted figure and an increase of 7.1%. Adding the 100 billion yuan contributed by the Central Budget Stabilization Fund, total revenue used by the central government came to 6.549001 trillion yuan. Expenditure from the central government's general public budget amounted to 7.417436 trillion yuan, 99.1% of the budgeted figure and an increase of 8.3% (this includes 2.256991 trillion yuan in central government spending, 100.3% of the budgeted figure and an increase of 10.2%). Adding the 81.565 billion yuan used to replenish the Central Budget Stabilization Fund, central government expenditure totaled 7.499001 trillion yuan. Total central government expenditure exceeded total central government revenue, leaving a deficit of 950 billion yuan, which was the figure budgeted for. Government bonds in the central budget had an outstanding balance of 9.565545 trillion yuan at the end of 2014, which meant it had been kept within the limit of 10.070835 trillion yuan budgeted for the year. The Central Budget Stabilization Fund had a balance of 134.115 billion yuan. | | 中央一般公共预算收入64490.01亿元,为预算的100.2%,增长7.1%。加上从中央预算稳定调节基金调入1000亿元,使用的收入总量为65490.01亿元。中央一般公共预算支出74174.36亿元,完成预算的99.1%,增长8.3%(其中,中央本级支出22569.91亿元,完成预算的100.3%,增长10.2%)。加上补充中央预算稳定调节基金815.65亿元,支出总量为74990.01亿元。收支总量相抵,中央财政赤字9500亿元,与预算持平。2014年末,中央财政国债余额95655.45亿元,控制在年度预算限额100708.35亿元以内;中央预算稳定调节基金余额1341.15亿元。 |

| |  |

| Figure 1 Balance of Central Government Finances in the General Public Budget in 2014 | | 图1 2014年中央一般公共预算平衡关系 |

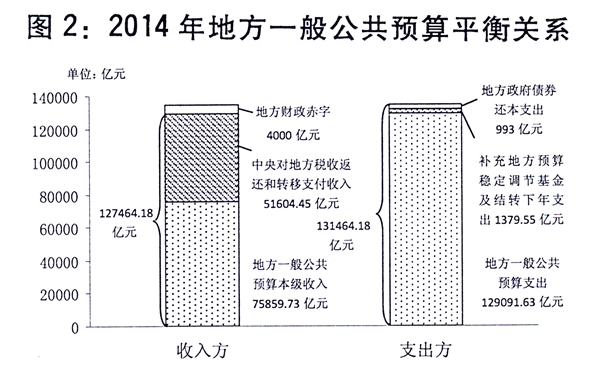

| Revenue in local governments' general public budgets came to 7.585973 trillion yuan, an increase of 9.9%. Adding the 5.160445 trillion yuan in tax rebates and transfer payments from the central government, local government revenue in their general public budgets totaled 12.746418 trillion yuan. Local government expenditure in their general public budgets amounted to 12.909163 trillion yuan, up 7.8%. Adding the 137.955 billion yuan used to replenish local budget stabilization funds and carried over to 2015 plus the 99.3 billion yuan used to repay the principal on local government bonds, local government expenditure totaled 13.146418 trillion yuan. Total expenditure of local governments exceeded their total revenue, leading to a local government deficit of 400 billion yuan. | | 地方一般公共预算本级收入75859.73亿元,增长9.9%。加上中央对地方税收返还和转移支付收入51604.45亿元,地方一般公共预算收入总量为127464.18亿元。地方一般公共预算支出129091.63亿元,增长7.8%。加上补充地方预算稳定调节基金及结转下年支出1379.55亿元、地方政府债券还本支出993亿元,支出总量为131464.18亿元。收支总量相抵,地方财政赤字4000亿元。 |

| |  |

| Figure 2 Balance of Local Government Finances in the General Public Budget in 2014 | | 图2 2014年地方一般公共预算平衡关系 |

| The following passages detail the specifics on the implementation of the central government's general public budget in 2014. | | 2014年中央一般公共预算收支执行具体情况如下: |

| 1) Main revenue items | | (1)主要收入项目执行情况。 |

| Domestic VAT revenue was 2.110297 trillion yuan, 97% of the budgeted figure. This shortfall was mainly due to increases in value added of industry and commodity prices being lower than projected at the beginning of the year, while the replacement of business tax with VAT also led to a considerable increase in business VAT deductions. Revenue from domestic consumption tax was 890.682 billion yuan, 100.4% of the budgeted figure. Revenue from VAT and consumption tax on imports amounted to 1.44244 trillion yuan, 96.6% of the budgeted figure. This discrepancy was mainly due to falls in both the prices of imported bulk commodities and the total volume of imports. Revenue from customs duties came to 284.319 billion yuan, 101.4% of the budgeted figure. Corporate income tax revenue was 1.58125 trillion yuan, 101.3% of the budgeted figure. Individual income tax revenue was 442.596 billion yuan, 103.2% of the budgeted figure. VAT and consumption tax rebates on exports came to 1.135648 trillion yuan, 100.2% of the budgeted figure. Non-tax revenue totaled 445.758 billion yuan, 119.3% of the budgeted figure, which was mainly attributable to the increase in profits turned over to the central government by some financial institutions. | | 国内增值税21102.97亿元,为预算的97%,主要是工业增加值增幅、物价涨幅低于年初预期,以及营改增后增值税进项税额抵扣增加较多。国内消费税8906.82亿元,为预算的100.4%。进口货物增值税、消费税14424.4亿元,为预算的96.6%,主要是大宗商品进口价格下滑、进口额下降等。关税2843.19亿元,为预算的101.4%。企业所得税15812.5亿元,为预算的101.3%。个人所得税4425.96亿元,为预算的103.2%。出口货物退增值税、消费税11356.48亿元,为预算的100.2%。非税收入4457.58亿元,为预算的119.3%,主要是部分金融机构上缴利润增加。 |

| Revenue in the central government's general public budget exceeded the budgeted figure by 11.001 billion yuan in 2014, which was used to replenish the Central Budget Stabilization Fund and carried over to 2015 budgets in accordance with the newly revised Budget Law and other relevant regulations. | | 2014年中央一般公共预算收入比预算超收110.01亿元。按照新预算法及有关文件规定,用于补充中央预算稳定调节基金,纳入2015年预算统筹安排使用。 |

| 2) Main expenditure items | | (2)主要支出项目执行情况。 |

| Expenditure on agriculture, forestry, and water conservancy reached 647.422 billion yuan, 99.8% of the budgeted figure and an increase of 8.4%. Of this total, central government spending accounts for 53.963 billion yuan, while transfer payments made to local governments account for 593.459 billion yuan. Trials were carried out to restore and improve cultivated land contaminated by heavy metals and deal comprehensively with the over-abstraction of groundwater. We implemented and improved policies on subsidies for farmers, and carried out trials in five provinces to subsidize major grain growers. The principle of giving high priority to saving water was put into action, leading to the improvement of small irrigation and water conservancy facilities in 1,200 key counties. Efforts to promote comprehensive agricultural development and upgrade low- and medium-yield cropland were stepped up, leading to the development of 1.8791 million hectares of high-grade cropland. Efforts were also devoted to cleaning up and improving the flood defenses of small and medium-sized rivers, with work completed on a total of 46,000 kilometers of river. Impetus was given to efforts to reinforce and improve the safety of small, poorly maintained reservoirs. We supported work to prevent flooding and fight drought. We supported the further mechanization of agriculture, and saw the overall level of mechanization in ploughing, sowing, and harvesting exceed 61%. New types of agricultural businesses were nurtured and supported. Improvements were made to the policy for supporting grassland ecological conservation, and subsidies were provided for 253.33 million hectares of grassland. We reformed the mechanisms for managing government poverty alleviation funds, ensuring that these funds were used to greater effect, and helped 12.32 million rural residents lift themselves out of poverty. Steady progress was made in the pilot reform to ensure guaranteed base prices for cotton and soybeans. The trial to comprehensively reform the pricing for water used in agriculture was deepened. We secured the completion of approximately 340,000 village-level public works projects launched on the basis of deliberation by villagers and covered by the government award and subsidy system. | | 农林水支出6474.22亿元,完成预算的99.8%,增长8.4%。其中,中央本级支出539.63亿元,对地方转移支付5934.59亿元。开展重金属污染耕地修复治理、地下水超采综合治理等试点。落实完善对农民的补贴政策,在5个省份开展种粮大户补贴试点。贯彻节水优先方针,推进1200个小型农田水利重点县建设。加大农业综合开发改造中低产田力度,建设高标准农田2818.6万亩。实施中小河流治理,完成治理河长4.6万公里。推进小型病险水库除险加固。支持做好防汛抗旱工作。支持农业机械化发展,全国农作物耕种收综合机械化水平超过61%。培育和支持新型农业生产经营主体。完善草原生态保护支持政策,对38亿亩草原给予补助。改革财政专项扶贫资金管理机制,提高扶贫资金使用效果,农村贫困人口减少1232万人。棉花、大豆目标价格改革试点稳步推进。深化农业水价综合改革试点。村级公益事业建设一事一议财政奖补项目完成约34万个。 |

| Spending on social security and employment totaled 706.609 billion yuan, 98.8% of the budgeted figure and an increase of 8.5%. The shortfall is mainly due to actual spending on natural disaster relief and subsidies for entitled groups being lower than the budgeted amount. The total includes 69.988 billion yuan in central government spending, and 636.621 billion yuan in transfer payments to local governments. We provided social security subsidies and subsidies for public-service job positions to assist those experiencing employment difficulties. We implemented an initiative to guide business startups and encouraged university students to seek employment or start their own businesses. Basic pensions for enterprise retirees were raised by 10%, with per capita monthly benefits reaching 2,068 yuan. We merged the new type of pension system for rural residents and the pension system for non-working urban residents, creating a basic pension scheme for rural and non-working urban residents. As of July 1, 2014, the per capita basic pension for people participating in the new insurance scheme was raised by 15 yuan per month. We further raised subsistence allowances for urban and rural residents. Work was done to ensure basic necessities for people experiencing extreme poverty, and we supported the nationwide implementation of the temporary assistance system. We increased subsidies and living allowances by at least 20% for disabled military personnel, families of revolutionary martyrs, Red Army veterans living in rural areas, elderly ex-servicepersons, and other entitled groups. We worked to protect and manage overseas memorials for Chinese martyrs who gave their lives outside of China. We established the system for providing subsidies for the very elderly and senior citizens suffering from loss of physical and/or mental capacity who are experiencing financial difficulties. | | 社会保障和就业支出7066.09亿元,完成预算的98.8%,增长8.5%,低于预算主要是据实结算的特大自然灾害救济费、优抚对象补助经费减少。其中,中央本级支出699.88亿元,对地方转移支付6366.21亿元。实施社会保险补贴和公益性岗位补贴,帮助就业困难人员就业。实施创业引领计划,鼓励高校毕业生就业创业。企业退休人员基本养老金水平提高10%,月人均达到2068元。将新型农村社会养老保险和城镇居民社会养老保险整合为城乡居民基本养老保险制度,从2014年7月1日起,按月人均增加15元调整城乡居民基本养老保险基础养老金标准。城乡低保标准进一步提高。做好特困人员供养工作,支持全面实施临时救助制度。残疾军人、烈属、在乡红军老战士和老复员军人等优抚对象的抚恤和生活补助标准提高20%以上。开展境外烈士纪念设施保护管理工作。建立经济困难的高龄、失能等老年人补贴制度。 |

| Spending on medical and health care and family planning came to 293.126 billion yuan, 96.5% of the budgeted figure and an increase of 11%. The shortfall is mainly due to the decreases in the actual expenditures on medical insurance for urban and rural residents and in the spending on public hospital reform, for which arrangements were made on the basis of progress in the reform of the medical and health care systems. This total consists of 9.025 billion yuan of central government spending and 284.101 billion yuan made in transfer payments to local governments. Government subsidies channeled through the new rural cooperative medical insurance system and the basic medical insurance system for non-working urban residents were increased to 320 yuan per person per annum. For this purpose, the central government increased subsidies to local governments, and rates for individual contributions were raised to 90 yuan per person per annum. We integrated all subsidies for medical assistance to urban and rural residents, and expanded the scope of assistance for medical care. We extended the major disease insurance pilot scheme for rural and non-working urban residents to all provinces, autonomous regions, and municipalities directly under the central government. We supported the establishment of a nationwide system of assistance for emergency medical treatment. A further 737 counties and 17 cities were selected to begin trials in comprehensive public hospital reform. We supported the launching of a standard training program for 50,000 resident physicians nationwide, and subsidized the training centers for the program. We increased annual per capita spending on basic public health services from 30 yuan to 35 yuan, and weighted spending to favor rural doctors. Work on the prevention and control of HIV/AIDS and other major diseases was strengthened, and support was given to help achieve nationwide coverage with work on nucleic acid testing and HIV/AIDS prevention for blocking mother-to-child transmission. We raised the special subsidies given to parents following the death of their only child and to parents whose only child suffers from some form of disability. | | 医疗卫生与计划生育支出2931.26亿元,完成预算的96.5%,增长11%,低于预算主要是据实结算的城乡居民医疗保险等支出以及根据医改工作进程安排的公立医院改革支出减少。其中,中央本级支出90.25亿元,对地方转移支付2841.01亿元。新型农村合作医疗和城镇居民基本医疗保险财政补助标准提高到每人每年320元,中央财政加大了对地方财政的补助力度,个人缴费标准也相应提高到每人每年90元。整合城乡医疗救助补助资金,进一步扩大了救助范围。城乡居民大病保险试点扩大到所有省份。支持全面建立疾病应急救助制度。新增737个县和17个城市开展公立医院综合改革试点。支持在全国范围启动5万名住院医师规范化培训,并对培训基地予以补助。基本公共卫生服务项目人均经费标准从30元提高到35元,并重点向村医倾斜。加强艾滋病等重大疾病防控工作,支持血液安全核酸检测和艾滋病等母婴阻断工作全覆盖。提高独生子女伤残、死亡家庭特别扶助金标准。 |

| Spending on education totaled 410.19 billion yuan, 99.2% of the budgeted figure and an increase of 8.2%. This total consists of 125.392 billion yuan of central government spending and 284.798 billion yuan made in transfer payments to local governments. The second phase of the three-year action plan for preschool education was launched; a pilot initiative for offering remote rural areas preschool education supported by volunteers on a rotating basis was put into action; and encouragement was given to the development of both government and private provision of education services to increase the resources for pre-schooling. We further improved the mechanisms for guaranteeing the funding for compulsory education in rural areas, made a further 40 yuan increase to the benchmark for public funding per student in primary and secondary schools in rural areas, and on top of this, further increased public funding for boarding schools in rural areas. We supported local governments in comprehensively improving the basic conditions of schools providing compulsory education in poor areas, so as to narrow the gap between urban and rural areas in terms of compulsory education. As of November 2014, the subsidy given to those areas covered by the pilot scheme to implement a national plan for improving the nutrition of students receiving compulsory education in rural areas was raised from three to four yuan per student per day, benefitting over 32 million primary and secondary school students. We continued to support local governments to effectively solve the issue of providing equal access to compulsory education for the children of migrant workers living with their parents in cities. We encouraged local governments to set up a sound, reform-oriented, and performance-based system for the allocation of funds on a per student basis for higher vocational schools. Adjustments and improvements were made to the method for providing government subsidies for the waiving of tuition fees at schools providing secondary vocational education; and by using awards in place of subsidies, support and guidance were given to local governments to optimize the distribution of secondary vocational schools and, on this basis, improve the basic conditions at these schools. We improved the system for allocating funds from the central budget to central government institutions of higher learning to help promote an internal quality building model of development of higher education. Support was continued for the development of local universities and colleges. We further improved the system of government financial aid policies; extended this assistance to cover preparatory students from ethnic minorities; and adjusted and refined the policies related to national education assistance loans, benefitting approximately 6.6 million college students, 4.88 million regular high school students, and 12.34 million secondary vocational school students. | | 教育支出4101.9亿元,完成预算的99.2%,增长8.2%。其中,中央本级支出1253.92亿元,对地方转移支付2847.98亿元。启动实施第二期学前教育三年行动计划,在偏远农村地区实施学前教育巡回支教试点,支持公办民办并举扩大学前教育资源。进一步完善农村义务教育经费保障机制,将农村中小学校生均公用经费基准定额再提高40元,在此基础上进一步提高寄宿制学校公用经费水平。支持地方全面改善贫困地区义务教育薄弱学校基本办学条件,缩小城乡义务教育差距。从2014年11月起将农村义务教育学生营养改善计划国家试点地区补助标准从每生每天3元提高到4元,惠及3200万名农村中小学生。继续支持地方解决好进城务工人员随迁子女平等接受义务教育问题。推动地方建立完善以改革和绩效为导向的高职院校生均拨款制度,调整完善中等职业教育免学费财政补助方式,通过“以奖代补”支持和引导地方在优化布局的基础上改善中等职业学校基本办学条件。健全体现内涵式发展的中央高校预算拨款制度。继续支持地方高校发展。进一步完善国家资助政策体系,将少数民族预科学生纳入国家资助范围,调整完善国家助学贷款相关政策,惠及约660万名高校学生、488万名普通高中学生和1234万名中职学生。 |

| Spending on science and technology came to 254.182 billion yuan, 95.1% of the budgeted figure and an increase of 3.5%. The main reason that total spending fell below the budgeted figure was that the allocation of funds to major national science and technology programs was carried out on the basis of their actual progress, and certain programs fell behind the schedules set in early 2014 due to the great difficulty of the research being conducted. This total is comprised of 243.666 billion yuan of central government spending and 10.516 billion yuan in transfer payments to local governments. Safeguards were provided for the implementation of major national science and technology programs, and important progress and breakthroughs were made in electronics, information, energy, environmental protection, biomedicine, advanced manufacturing, and other fields. Strong support was given for basic research, strengthening the groundwork for making national innovations. Impetus was given to research on cutting-edge technologies and major generic key technologies, as well as research for the public benefit, and the integration of science and technology with industry was strengthened. We supported the building of platforms for innovation in science and technology, including basic national science and technology facilities, and key national laboratories, and worked to help ensure that scientific and technological resources are openly shared. We launched the national seed fund for encouraging the application of advances in science and technology, and drew on market mechanisms to promote the use of advances in science and technology for profit and for application in industry. Support was given to making major advances in the development of the national defense science and technology industry. | | 科学技术支出2541.82亿元,完成预算的95.1%,增长3.5%,低于预算主要是国家科技重大专项根据科研进度据实安排,部分专项研制难度大,2014年实际进度低于年初计划。其中,中央本级支出2436.66亿元,对地方转移支付105.16亿元。保障国家科技重大专项实施,在电子信息、能源环保、生物医药、先进制造等方面取得重要突破和进展。大力支持基础研究,强化自主创新成果的源头供给。推动前沿技术研究、社会公益研究和重大共性关键技术研究,强化科技与产业的结合。支持国家科技基础条件平台、国家重点实验室等科技创新平台建设,推动科技资源开放共享。启动实施国家科技成果转化引导基金,运用市场机制促进科技成果资本化、产业化。支持国防科技工业跨越式发展。 |

| Spending on culture, sports, and media totaled 50.815 billion yuan, 99.2% of the budgeted figure and an increase of 8.3%. This figure is comprised of 22.269 billion yuan of central government spending and 28.546 billion yuan made in transfer payments to local governments. Efforts were continued to open more public cultural facilities such as public libraries, museums, and memorial halls to the public free of charge. Efforts were stepped up to extend wireless digitalized coverage of central radio and television programming. Support was provided for the protection of cultural heritage, and trials were launched to preserve 327 traditional villages. Work was begun to provide funding through the China National Arts Fund, and following assessment, 393 projects were selected to be granted funding. Efforts were made to see that large stadiums and gymnasiums are opened to the public free of charge or at low cost, and further improvements were made to community sports and fitness facilities. Support was given for the introduction of soccer in schools. Support was also given for the development of cultural industries, and encouragement was given to the integrated development of cultural and creative industries, design services, and other related industries. | | 文化体育与传媒支出508.15亿元,完成预算的99.2%,增长8.3%。其中,中央本级支出222.69亿元,对地方转移支付285.46亿元。继续推进公共图书馆、博物馆、纪念馆等公益性文化设施向社会免费开放。加快中央广播电视节目无线数字化覆盖。支持文化遗产保护,开展327个传统村落保护试点。启动国家艺术基金资助工作,评审确定资助项目393个。推动大型体育场馆向社会免费或低收费开放,进一步改善基层公共体育健身设施。支持开展校园足球活动。支持发展文化产业,推进文化创意和设计服务与相关产业融合发展。 |

| Spending on guaranteeing housing totaled 252.978 billion yuan, 100% of the budgeted figure and an increase of 9%. This figure consists of 40.541 billion yuan of central government spending and 212.437 billion yuan made in transfer payments to local governments. We integrated the central government funds earmarked for low-rental housing, public rental housing, and the redevelopment of rundown urban areas. Work to integrate the operations of public- and low-rental housing moved forward. Policies were launched to subsidize the interest on loans used to finance the construction of government-subsidized housing in urban areas. Construction on 5.11 million units of government-subsidized housing in urban areas was basically completed, and construction was begun on another 7.4 million units. Support was given to the renovation of dilapidated housing for 2.66 million poor rural households. | | 住房保障支出2529.78亿元,完成预算的100%,增长9%。其中,中央本级支出405.41亿元,对地方转移支付2124.37亿元。整合中央补助廉租住房、公共租赁住房和城市棚户区改造专项资金。推进公共租赁住房和廉租住房并轨运行。出台城镇保障性安居工程贷款贴息政策。新开工城镇保障性安居工程740万套,基本建成511万套。支持266万贫困农户改造危房。 |

| Spending on energy conservation and environmental protection came to 203.281 billion yuan, 96.4% of the budgeted figure and an increase of 3.2%. The shortfall is primarily due to spending on subsidies for encouraging the sale of energy-efficient vehicles with engine displacement of 1.6 liters or less being lower than anticipated. The total is made up of 34.453 billion yuan of central government spending and 168.828 billion yuan made in transfer payments to local governments. Support was increased for efforts to prevent and control air pollution in Beijing, Tianjin, Hebei, and their surrounding areas as well as in the Yangtze River and Pearl River deltas. Support was also given for the building of over 1,400 air monitoring stations across China. Trials were launched to comprehensively improve the conditions of rivers, covering each river's entire drainage basin. We moved ahead the trials for the areas along the Xin' an River basin to compensate each other for their impact on water quality, and moved forward with efforts to establish a mechanism for provinces to compensate each other for ecological damage or the costs of ecological protection. A total of 14,100 kilometers of pipe networks was constructed to complement urban sewage treatment facilities. Contiguous environmental improvement initiatives were launched in 13,112 villages, directly benefitting approximately 15.8 million people. Efforts were begun to ensure mineral resources are being used comprehensively, and improvements were made to the environment in contiguous mining areas. The trial to completely stop logging in key state-owned forest areas was launched in Heilongjiang Province. We supported the implementation of a new round of efforts to return 333,000 hectares of marginal arable land back into forest or grassland. This year's task of closing down outdated production facilities in 15 key industries including steel and cement was completed. We supported problem-solving in the development of technologies for new-energy vehicles as well as demos and promotional work for the vehicles, and encouraged the development of the energy conservation and environmental protection industries. We extended the scope of comprehensive demonstrations of energy conservation and emission reduction based on integrating financial policies. Efforts were stepped up to develop new energy and renewable energy. | | 节能环保支出2032.81亿元,完成预算的96.4%,增长3.2%,低于预算主要是1.6升及以下节能汽车推广补贴比预计数减少。其中,中央本级支出344.53亿元,对地方转移支付1688.28亿元。加大对京津冀及周边、长三角、珠三角区域大气污染防治的支持力度。支持在全国建成1400多个空气监测站点。以流域为单元开展国土江河综合整治试点。深化新安江水环境补偿试点,推进横向生态补偿机制建设。建设城镇污水处理设施配套管网1.41万公里。在13112个村开展环境连片整治,直接受益人口约1580万人。开展矿产资源综合利用,实施矿山环境连片治理。启动黑龙江重点国有林区全面停伐试点。支持实施新一轮退耕还林还草500万亩。完成钢铁、水泥等15个重点行业淘汰落后产能年度任务。支持新能源汽车技术攻关和示范推广,鼓励节能环保产业发展。扩大节能减排财政政策综合示范范围。加快推进新能源和可再生能源发展。 |

| Spending on transport totaled 426.98 billion yuan, 98.3% of the budgeted figure and an increase of 3.3%. Spending on stockpiling grain, edible oils, and other materials stood at 153.975 billion yuan, 110.5% of the budgeted figure and an increase of 21.6%. The excess is mainly due to an increase in central government spending on subsidizing interest payments made for stockpiling grain and edible oils and the expenses for purchasing japonica rice and corn from northeast China. Spending on national defense was 808.288 billion yuan, 100% of the budgeted figure and an increase of 12.2%. Spending on public security came to 212.027 billion yuan, 103.4% of the budgeted figure and an increase of 9.7%. Spending on general public services totaled 125.134 billion yuan, 100.5% of the budgeted figure and an increase of 3.1%. | | 交通运输支出4269.8亿元,完成预算的98.3%,增长3.3%。粮油物资储备支出1539.75亿元,完成预算的110.5%,增长21.6%,高于预算主要是中央储备粮油利息费用补贴、采购东北粳稻和玉米费用补贴等支出增加。国防支出8082.88亿元,完成预算的100%,增长12.2%。公共安全支出2120.27亿元,完成预算的103.4%,增长9.7%。一般公共服务支出1251.34亿元,完成预算的100.5%,增长3.1%。 |

| 3) Central government tax rebates and transfer payments to local governments. | | (3)中央对地方税收返还和转移支付执行情况。 |

| Central government tax rebates and transfer payments to local governments totaled 5.160445 trillion yuan, 99.5% of the budgeted figure and an increase of 7.5%. This figure includes 2.756739 trillion yuan in general transfer payments and 1.894072 trillion yuan in special transfer payments. General transfer payments accounted for 59.3% of total transfer payments, an increase of 2.2 percentage points over 2013. | | 中央对地方税收返还和转移支付51604.45亿元,完成预算的99.5%,增长7.5%。其中,一般性转移支付27567.39亿元,专项转移支付18940.72亿元。一般性转移支付占全部转移支付的59.3%,比2013年提高2.2个百分点。 |

| (2) Budgets for government-managed funds. | | 2.政府性基金预算。 |

| In 2014, revenue from government-managed funds nationwide came to 5.409338 trillion yuan, and expenditure from these funds amounted to 5.138775 trillion yuan. | | 2014年全国政府性基金收入54093.38亿元,全国政府性基金支出51387.75亿元。 |

| Revenue from central government-managed funds totaled 409.751 billion yuan, 98.3% of the budgeted figure and a decrease of 3.3%. Adding the 90.713 billion yuan carried forward from 2013, revenue from central government-managed funds totaled 500.464 billion yuan in 2014. Expenditure from central government-managed funds totaled 431.954 billion yuan, 86.8% of the budgeted figure and an increase of 3.4%. Of this, central government spending was 296.392 billion yuan and transfer payments to local governments amounted to 135.562 billion yuan. A total of 68.51 billion yuan has been carried forward to 2015 from central government-managed funds. | | 中央政府性基金收入4097.51亿元,为预算的98.3%,下降3.3%。加上2013年结转收入907.13亿元,中央政府性基金收入总量为5004.64亿元。中央政府性基金支出4319.54亿元,完成预算的86.8%,增长3.4%。其中,中央本级支出2963.92亿元,对地方转移支付1355.62亿元。中央政府性基金结转下年支出685.1亿元。 |

| Revenue from funds managed by local governments reached 4.999587 trillion yuan, an increase of 4.1%. This figure includes 4.26059 trillion yuan from the sale of state-owned land-use rights. Adding the 135.562 billion yuan in transfer payments from central government-managed funds, total revenue from local government- managed funds was 5.135149 trillion yuan. Expenditure from local government- managed funds totaled 4.842383 trillion yuan, an increase of 1.4%. This includes 4.120245 trillion yuan of spending from the proceeds of selling state-owned land-use rights. | | 地方政府性基金本级收入49995.87亿元,增长4.1%。其中,国有土地使用权出让收入42605.9亿元。加上中央政府性基金对地方转移支付收入1355.62亿元,地方政府性基金收入为51351.49亿元。地方政府性基金支出48423.83亿元,增长1.4%。其中,国有土地使用权出让收入安排的支出41202.45亿元。 |

| (3) Budgets for state capital operations | | 3.国有资本经营预算。 |

| In 2014, budgetary revenue from state capital operations nationwide totaled 202.344 billion yuan, and budgetary expenditure on state capital operations totaled 199.995 billion yuan. | | 2014年全国国有资本经营预算收入2023.44亿元,全国国有资本经营预算支出1999.95亿元。 |

| Budgetary revenue from the central government's state capital operations totaled 141.091 billion yuan, 98.9% of the budgeted figure and an increase of 33.3%. Adding the 15.219 billion yuan carried forward from 2013, total revenue stood at 156.31 billion yuan. Budgetary spending on the central government's state capital operations came to 141.912 billion yuan, 89.9% of the budgeted figure and an increase of 45.1%. Of this, 18.4 billion yuan, an increase of 183.1%, was brought into the general public budget and spent on social security and other areas related to the people's quality of life. Surplus budgetary revenue from the central government's state capital operations, totaling 14.398 billion yuan, was carried over to 2015. | | 中央国有资本经营预算收入1410.91亿元,为预算的98.9%,增长33.3%。加上2013年结转收入152.19亿元,收入总量为1563.1亿元。中央国有资本经营预算支出1419.12亿元,完成预算的89.9%,增长45.1%。其中,调入一般公共预算用于社会保障等民生支出184亿元,增长183.1%。中央国有资本经营预算结转下年支出143.98亿元。 |

| Budgetary revenue from state capital operations of local governments totaled 61.253 billion yuan, and total budgetary spending amounted to 58.083 billion yuan. Surplus budgetary revenue from state capital operations of local governments was carried forward to 2015. | | 地方国有资本经营预算收入612.53亿元,地方国有资本经营预算支出580.83亿元。地方国有资本经营预算收大于支的部分结转下年使用。 |

| (4) Budgets for social security funds | | 4.社会保险基金预算。 |

In 2014, revenue from social security funds nationwide totaled 3.918646 trillion yuan, 104% of the budgeted figure. This includes 2.91041 trillion yuan of insurance premiums and 844.635 billion yuan of government subsidies. Social security fund expenditure totaled 3.366912 trillion yuan nationwide, 103.3% of the budgeted figure. Revenue exceeded expenditure in 2014, leaving a surplus of 551.734 billion yuan, and the year-end balance reached 5.040876 trillion yuan after the surplus in 2014 was rolled over.

...... | | 2014年全国社会保险基金收入39186.46亿元,为预算的104%。其中,保险费收入29104.1亿元,财政补贴收入8446.35亿元。全国社会保险基金支出33669.12亿元,完成预算的103.3%。当年收支结余5517.34亿元,年末滚存结余50408.76亿元。

...... |

|

Dear visitor, as a premium member of this database, you will get complete access to all content.Please go premium and get more.

1. To become a premium member, please call 400-810-8266 Ext. 171.

2. Binding to the account with access to this database.

3. Apply for a trial account.

4. To get instant access to a document, you can Pay Amount 【¥2400.00】 for your single purchase. | |

您好:您现在要进入的是北大法宝英文库会员专区。

如您是我们英文用户可直接 登录,进入会员专区查询您所需要的信息;如您还不是我们 的英文用户;您可通过网上支付进行单篇购买,支付成功后即可立即查看本篇内容。

Tel: +86 (10) 82689699, +86 (10) 82668266 ext. 153

Mobile: +86 13311570713

Fax: +86 (10) 82668268

E-mail:info@chinalawinfo.com

|

| | | |

| | | |