| Announcement of the Ministry of Finance and the State Taxation Administration on Relevant Individual Income Tax Policies Regarding Non-Resident Individuals and Resident Individuals Who Are Not Domiciled in China | | 财政部、税务总局关于非居民个人和无住所居民个人有关个人所得税政策的公告 |

| (Announcement No. 35 [2019] of the Ministry of Finance and the State Taxation Administration) | | (财政部、税务总局公告2019年第35号) |

| For the purpose of implementing the amended Individual Income Tax Law of the People's Republic of China (hereinafter referred to as the “Tax Law”) and the Regulation on the Implementation of the Individual Income Tax Law of the People's Republic of China (hereinafter referred to as the “Implementation Regulation”), the relevant individual income tax policies regarding non-resident individuals and resident individuals who are not domiciled in China (hereinafter collectively referred to as “individuals who are not domiciled in China”) are hereby announced as follows: | | 为贯彻落实修改后的《中华人民共和国个人所得税法》(以下称税法)和《中华人民共和国个人所得税法实施条例》(以下称实施条例),现将非居民个人和无住所居民个人(以下统称无住所个人)有关个人所得税政策公告如下: |

| I. Issues concerning the source of incomes | | 一、关于所得来源地 |

| (1) Provisions on the source of income from wages and salaries. | | (一)关于工资薪金所得来源地的规定。 |

| The income from wages and salaries obtained by an individual for the period of his or her working within the territory of China (hereinafter referred to as “inside China”) is the income from wages and salaries derived from inside China. The period of his or her working inside China shall be calculated according to the number of days of his or her working inside China, including the number of his or her actual working days inside China, and the number of the public holidays, personal leaves, and training days he or she may enjoy both at home and abroad during the period of his or her working inside China. Where an individual who holds posts both at home and abroad or only holds a post in an entity outside China spends less than 24 hours inside China on the day of his or her stay in China, that day shall be counted as half a day of working inside China. | | 个人取得归属于中国境内(以下称境内)工作期间的工资薪金所得为来源于境内的工资薪金所得。境内工作期间按照个人在境内工作天数计算,包括其在境内的实际工作日以及境内工作期间在境内、境外享受的公休假、个人休假、接受培训的天数。在境内、境外单位同时担任职务或者仅在境外单位任职的个人,在境内停留的当天不足24小时的,按照半天计算境内工作天数。 |

| If an individual who is not domiciled in China holds posts both at home and abroad or only holds a post in an entity outside China, and works both inside and outside China in the current period, the amount of his or her income from wages and salaries derived from inside/outside China shall be calculated and determined according to the proportion of the number of days of his or her working inside/outside China during which wages and salaries are generated to the number of Gregorian calendar days in the current period. The number of days of working outside China shall be the number of Gregorian calendar days in the current period less the number of days of working inside China in the current period. | | 无住所个人在境内、境外单位同时担任职务或者仅在境外单位任职,且当期同时在境内、境外工作的,按照工资薪金所属境内、境外工作天数占当期公历天数的比例计算确定来源于境内、境外工资薪金所得的收入额。境外工作天数按照当期公历天数减去当期境内工作天数计算。 |

| (2) Provisions on the source of income from several months' bonuses or equity incentives. | | (二)关于数月奖金以及股权激励所得来源地的规定。 |

| If the source of income from several months' bonuses or equity incentives obtained by an individual who is not domiciled in China is determined in accordance with subparagraph (1) of this Article, the income from wages and salaries derived from outside China shall be the portion for the period of working outside China of the income from several months' bonuses or equity incentives received by the individual who is not domiciled in China while performing or exercising his or her duties inside China; and the income from wages and salaries derived from inside China shall be the portion for the period of working inside China of the income from several months' bonuses or equity incentives received by an the individual who is not domiciled in China after stopping performing the contract or performing his or her duties inside China and leaving China. The specific calculation method is as follows: several months' bonuses or equity incentives multiplied by the proportion of the days of working inside China in the working period during which several months' bonuses or equity incentives are generated to the Gregorian calendar days in the corresponding working period. | | 无住所个人取得的数月奖金或者股权激励所得按照本条第(一)项规定确定所得来源地的,无住所个人在境内履职或者执行职务时收到的数月奖金或者股权激励所得,归属于境外工作期间的部分,为来源于境外的工资薪金所得;无住所个人停止在境内履约或者执行职务离境后收到的数月奖金或者股权激励所得,对属于境内工作期间的部分,为来源于境内的工资薪金所得。具体计算方法为:数月奖金或者股权激励乘以数月奖金或者股权激励所属工作期间境内工作天数与所属工作期间公历天数之比。 |

| Where the several months' bonuses or equity incentives obtained by an individual who is not domiciled in China within one month from inside and outside China include the multiple incomes for different periods, the incomes derived from inside China for different periods shall be first calculated respectively according to the provisions of this Announcement, and then plus the amount of income from several months' bonuses or equity incentives derived from inside China for the current month shall be calculated in an aggregated way. | | 无住所个人一个月内取得的境内外数月奖金或者股权激励包含归属于不同期间的多笔所得的,应当先分别按照本公告规定计算不同归属期间来源于境内的所得,然后再加总计算当月来源于境内的数月奖金或者股权激励收入额。 |

| For the purpose of this Announcement, “several months' bonuses” means income from wages and salaries, such as bonuses, year-end pay rises, and dividends for several months obtained in a single payment, excluding bonuses paid regularly each month and several months' wages paid in a lump sum. For the purpose of this Announcement, “equity incentives” include stock options, equity options, restricted stocks, stock appreciation rights, equity rewards, and other discounts and subsidies obtained by individuals from employers for their subscription of stocks or other negotiable securities. | | 本公告所称数月奖金是指一次取得归属于数月的奖金、年终加薪、分红等工资薪金所得,不包括每月固定发放的奖金及一次性发放的数月工资。本公告所称股权激励包括股票期权、股权期权、限制性股票、股票增值权、股权奖励以及其他因认购股票等有价证券而从雇主取得的折扣或者补贴。 |

| (3) Provisions on the source of income from remunerations obtained by directors, supervisors and senior executives. | | (三)关于董事、监事及高层管理人员取得报酬所得来源地的规定。 |

| No matter whether an individual serving as a director or supervisor or holding a senior management position of a resident enterprise inside China (hereinafter collectively referred to as a “senior executive”) performs his or her duties inside China, the directors' fees, supervisors' fees, wages and salaries, or other similar remunerations ((hereinafter collectively referred to as “remunerations of senior executives,” including several months' bonuses or equity incentives) paid or borne by resident enterprises inside China he or she obtains shall fall within the scope of income derived from inside China. | | 对于担任境内居民企业的董事、监事及高层管理职务的个人(以下统称高管人员),无论是否在境内履行职务,取得由境内居民企业支付或者负担的董事费、监事费、工资薪金或者其他类似报酬(以下统称高管人员报酬,包含数月奖金和股权激励),属于来源于境内的所得。 |

| For the purpose of this Announcement, “senior management positions” include enterprises' chief and deputy (general) managers, chief personnel performing various functions, directors, and other positions similar to companies' management. | | 本公告所称高层管理职务包括企业正、副(总)经理、各职能总师、总监及其他类似公司管理层的职务。 |

| (4) Provisions on the source of income from author's remuneration | | (四)关于稿酬所得来源地的规定。 |

| The income from author's remuneration paid or borne by an enterprise, public institution or any other organization inside China is income derived from inside China. | | 由境内企业、事业单位、其他组织支付或者负担的稿酬所得,为来源于境内的所得。 |

| II. Calculation of the amount of income from wages and salaries of an individual who is not domiciled in China | | 二、关于无住所个人工资薪金所得收入额计算 |

| Of the income from wages and salaries obtained by an individual who is not domiciled in China, the amount of the taxable income from wages and salaries inside China (hereinafter referred to as “amount of income from wages and salaries”) shall be calculated under the following provisions: | | 无住所个人取得工资薪金所得,按以下规定计算在境内应纳税的工资薪金所得的收入额(以下称工资薪金收入额): |

| (1) where an individual who is not domiciled in China is a non-resident individual. | | (一)无住所个人为非居民个人的情形。 |

| As for the income from wages and salaries obtained by a non-resident individual, the amount of income from wages and salaries for the current month shall be calculated according to the following circumstances, except as otherwise provided for in subparagraph (3) of this Article: | | 非居民个人取得工资薪金所得,除本条第(三)项规定以外,当月工资薪金收入额分别按照以下两种情形计算: |

| (a) where the non-resident individual has resided in the aggregate for not more than 90 days inside China | | 1.非居民个人境内居住时间累计不超过90天的情形。 |

| A non-resident individual who has resided in the aggregate for not more than 90 days inside China within a tax year only needs to calculate and pay individual income tax on the wages and salaries which are earned during his or her working inside China and paid and borne by the employer inside China. The formula for computing the income from wages and salaries for the current month (Formula 1) is as follows: | | 在一个纳税年度内,在境内累计居住不超过90天的非居民个人,仅就归属于境内工作期间并由境内雇主支付或者负担的工资薪金所得计算缴纳个人所得税。当月工资薪金收入额的计算公式如下(公式一): |

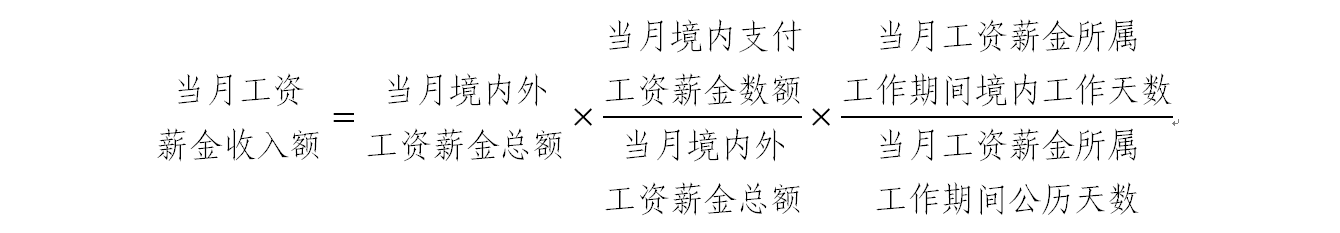

| Amount of income from wages and salaries for the current month = total amount of wages and salaries obtained inside and outside China in the current month ×(amount of income from wages and salaries paid inside China in the current month/total amount of wages and salaries obtained at home and abroad in the current month) ×(number of days of working inside China in the working period during which wages and salaries for the current month are generated/number of Gregorian calendar days in the working period during which wages and salaries for the current month are obtained) | |  |

| For the purpose of this Announcement, “employers inside China” include the domestic entities and individuals that employ employees and the institutions and establishments inside China of overseas entities or individuals. Where an employer inside China is subject to income tax collection on a deemed basis or has no operating income on which on income tax is levied, the income from wages and salaries obtained by an individual who is not domiciled in China who works for it shall be deemed to be paid or borne by such employer inside China, no matter whether such income is recorded in the accounting book of such employer inside China. For the purpose of this Announcement, “number of Gregorian calendar days in the working period during which income from wages and salaries is generated” means the number of days calculated based on Gregorian calendar in the working period during which the income from wages and salaries obtained by an individual who is not domiciled in China is generated. | | 本公告所称境内雇主包括雇佣员工的境内单位和个人以及境外单位或者个人在境内的机构、场所。凡境内雇主采取核定征收所得税或者无营业收入未征收所得税的,无住所个人为其工作取得工资薪金所得,不论是否在该境内雇主会计账簿中记载,均视为由该境内雇主支付或者负担。本公告所称工资薪金所属工作期间的公历天数,是指无住所个人取得工资薪金所属工作期间按公历计算的天数。 |

| Where the wages and salaries obtained inside and outside China in the current month as listed in the formula include multiple sums of wages and salaries for different periods, the amounts of income from wages and salaries for different periods shall be first calculated according to the provisions of this Announcement, and then the income from wages and salaries for the current month shall be calculated. | | 本公告所列公式中当月境内外工资薪金包含归属于不同期间的多笔工资薪金的,应当先分别按照本公告规定计算不同归属期间工资薪金收入额,然后再加总计算当月工资薪金收入额。 |

| (b) where the non-resident individual has resided in the aggregate for not less than 90 nor more than 183 days inside China | | 2.非居民个人境内居住时间累计超过90天不满183天的情形。 |

| A non-resident individual who has resided in the aggregate for 90 up to 183 days inside China within a tax year shall calculate and pay individual income tax on the income from wages and salaries for the period of his or her working inside China; and no individual income tax shall be levied on the income from wages and salaries for the period of his or her working outside China he or she obtains. The formula for computing the income from wages and salaries for the current month (Formula 2) is as follows: | | 在一个纳税年度内,在境内累计居住超过90天但不满183天的非居民个人,取得归属于境内工作期间的工资薪金所得,均应当计算缴纳个人所得税;其取得归属于境外工作期间的工资薪金所得,不征收个人所得税。当月工资薪金收入额的计算公式如下(公式二): |

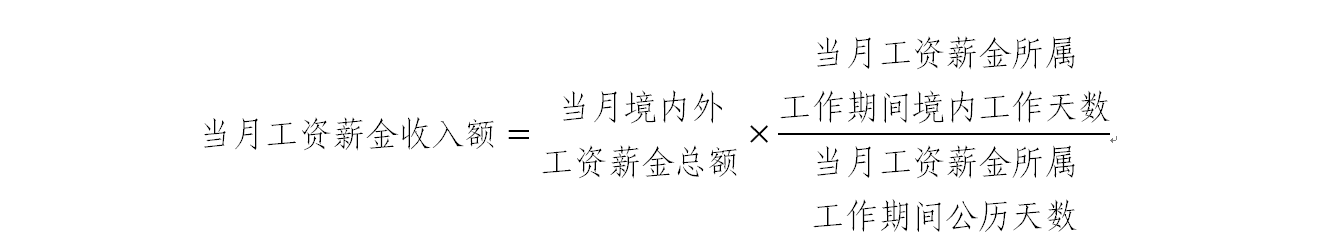

| Amount of income from wages and salaries for the current month = total amount of wages and salaries obtained inside and outside China in the current month× (number of days of working inside China in the working period during which wages and salaries for the current month are generated/number of Gregorian calendar days in the working period during which wages and salaries for the current month are generated) | |  |

| (2) where an individual who is not domiciled in China is a resident individual | | (二)无住所个人为居民个人的情形。 |

| Of the amount of wages and salaries obtained by a resident individual who is not domiciled in China and has resided in China for a total of 183 days or more during a tax year, the amount of income from wages and salaries for the current year shall be calculated according to the following provisions: | | 在一个纳税年度内,在境内累计居住满183天的无住所居民个人取得工资薪金所得,当月工资薪金收入额按照以下规定计算: |

| (a) Where the number of consecutive years in each of which a resident individual who is not domiciled in China has resided in China for a total of 183 days or more is less than six. | | 1.无住所居民个人在境内居住累计满183天的年度连续不满六年的情形。 |

| Where the number of consecutive years in each of which a resident individual who is not domiciled in China has stayed in China for a total of 183 days or more is less than six, and the individual is eligible for the preference as prescribed in Article 4 of the Implementation Regulation, individual income tax shall be calculated and paid on all the income from wages and salaries he or she has obtained, excluding the income from wages and salaries for the period of his or her working abroad and paid by overseas entities or individuals. The formula for computing the income from wages and salaries (Formula 3) is as follows: | | 在境内居住累计满183天的年度连续不满六年的无住所居民个人,符合实施条例第四条优惠条件的,其取得的全部工资薪金所得,除归属于境外工作期间且由境外单位或者个人支付的工资薪金所得部分外,均应计算缴纳个人所得税。工资薪金所得收入额的计算公式如下(公式三): |

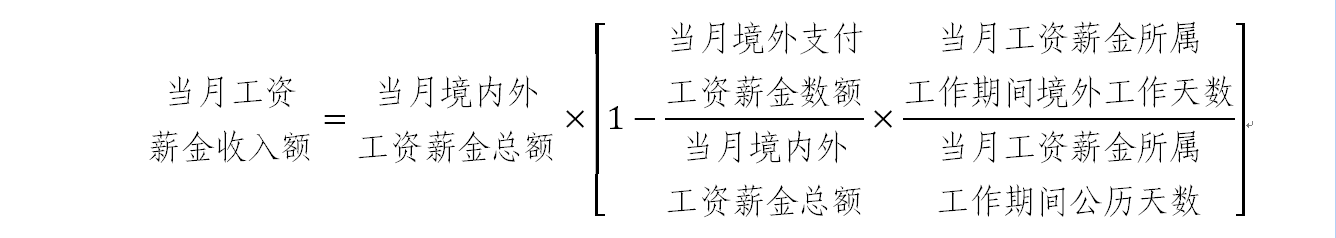

| Amount of income from wages and salaries for the current month = total amount of wages and salaries obtained inside and outside China in the current month ×[1-(amount of wages and salaries paid overseas in the current month/total amount of wages and salaries obtained inside and outside China in the current month) ×(number of days of working outside China in the working period during which wages and salaries for the current month are generated/number of Gregorian calendar days in the working period during which wages and salaries for the current month are generated)] | |  |

| (b) where the number of consecutive years in each of which a resident individual who is not domiciled in China has resided for a total of 183 days or more in China is six or more. | | 2.无住所居民个人在境内居住累计满183天的年度连续满六年的情形。 |

| Where a resident individual who is not domiciled in China is ineligible for the preference as prescribed in Article 4 of the Implementation Regulation after six consecutive years or more in each of which he or she has stayed in the aggregate for 183 days or more in China have lapsed, individual income tax shall be calculated and paid on all the income from wages and salaries he or she has obtained inside and outside China. | | 在境内居住累计满183天的年度连续满六年后,不符合实施条例第四条优惠条件的无住所居民个人,其从境内、境外取得的全部工资薪金所得均应计算缴纳个人所得税。 |

| (3) where an individual who is not domiciled in China is a senior executive | | (三)无住所个人为高管人员的情形。 |

| Where an individual who is not domiciled in China is a senior executive, the amount of income from wages and salaries shall be calculated and paid in accordance with subparagraph (2) of this Article. Where a non-resident individual is a senior executive, relevant matters shall be handled in accordance with the following provisions: | | 无住所居民个人为高管人员的,工资薪金收入额按照本条第(二)项规定计算纳税。非居民个人为高管人员的,按照以下规定处理: |

| (a) where a senior executive has resided in the aggregate for not more than 90 days in China | | 1.高管人员在境内居住时间累计不超过90天的情形。 |

| A senior executive who has resided in China for not more than 90 days in China within a tax year, individual income tax shall be calculated and paid on the his or her income from wages and salaries paid or borne by his or her employer inside China; and if such income from wages and salaries is not paid or borne by his or her employer inside China, no individual income tax shall be paid. The amount of income from wages and salaries for the current month shall be amount of income from wages and salaries paid or borne inside China in the current month. | | 在一个纳税年度内,在境内累计居住不超过90天的高管人员,其取得由境内雇主支付或者负担的工资薪金所得应当计算缴纳个人所得税;不是由境内雇主支付或者负担的工资薪金所得,不缴纳个人所得税。当月工资薪金收入额为当月境内支付或者负担的工资薪金收入额。 |

| (b) where a senior executive has resided in the aggregate for not less than 90 days nor more than 183 days in China | | 2.高管人员在境内居住时间累计超过90天不满183天的情形。 |

| A senior executive who has resided in China for more than 90 days but less than 183 days within a tax year, individual income tax shall be calculated and paid on his or her income from wages and salaries, excluding the income from wages and salaries for the period of his or her working abroad not paid by overseas entities or individuals. The amount of income from wages and salaries for the current month shall be calculated based on Formula 3 in this Announcement. | | 在一个纳税年度内,在境内居住累计超过90天但不满183天的高管人员,其取得的工资薪金所得,除归属于境外工作期间且不是由境内雇主支付或者负担的部分外,应当计算缴纳个人所得税。当月工资薪金收入额计算适用本公告公式三。 |

III. Issues concerning the calculation of taxes payable by an individual who is not domiciled in China

...... | | 三、关于无住所个人税款计算

...... |

|

Dear visitor, as a premium member of this database, you will get complete access to all content.Please go premium and get more.

1. To become a premium member, please call 400-810-8266 Ext. 171.

2. Binding to the account with access to this database.

3. Apply for a trial account.

4. To get instant access to a document, you can Pay Amount 【¥800.00】 for your single purchase. | |

您好:您现在要进入的是北大法宝英文库会员专区。

如您是我们英文用户可直接 登录,进入会员专区查询您所需要的信息;如您还不是我们 的英文用户;您可通过网上支付进行单篇购买,支付成功后即可立即查看本篇内容。

Tel: +86 (10) 82689699, +86 (10) 82668266 ext. 153

Mobile: +86 13311570713

Fax: +86 (10) 82668268

E-mail:info@chinalawinfo.com

|

| | | |

| | | |